You've successfully copied this link.

How would Brexit impact Chinese property investors?

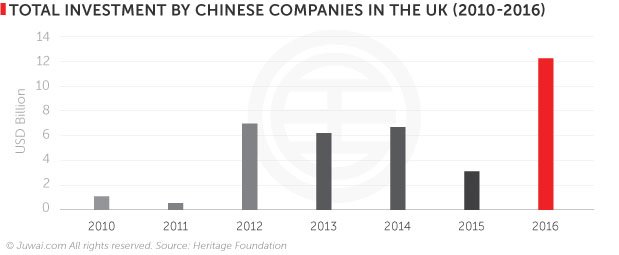

China-UK investment accelerated to $12.36 billion in 20161, a strong indication that Chinese investors remain undaunted by a looming Brexit.

Following the June 2016 Brexit vote, UK assets were so appealing that Chinese investors pumped $8.57 billion worth of investment into the UK during H2 2016, dwarfing the $3.78 billion invested in H1 2016, as well as beating the average annual investment of $4.12 billion between 2010 and 2015.1

With Chinese companies having purchased $1.43 billion worth of UK property assets – up 12.5% y-o-y – it's clear to see that UK property featured prominently in this Chinese investment surge into the UK.1

Notable property deals include China Vanke’s $150-million purchase of Ryder Court from Henderson2, and China Minsheng’s $110-million acquisition of Societe Generale’s London HQ.3

Unsurprisingly, this wide-ranging trend also saw residential property in the UK experiencing an upsurge in Chinese demand post-Brexit vote.

Searches for UK property by Chinese buyers on Juwai.com were up 32.5% y-o-y in February 2017.4

Economic prospects have improved following the Brexit vote

In part, this rising demand from mainland investors is because the UK’s economic prospects have improved, as well as the fact that Chinese buying power has grown, thanks to the RMB that has appreciated close to 10% since the Brexit referendum.

In part, this rising demand from mainland investors is because the UK’s economic prospects have improved, as well as the fact that Chinese buying power has grown, thanks to the RMB that has appreciated close to 10% since the Brexit referendum.

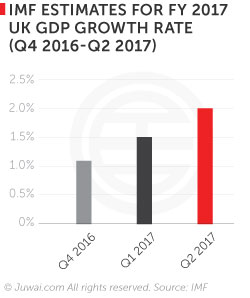

The International Monetary Fund (IMF) has also raised the UK’s economic outlook twice for 2016 and 20175 since the June 2016 Brexit vote, which makes the UK the fastest-growing G7 economy.6

This, in turn, has buoyed Chinese investor confidence in the UK, which has long been one of the top investment destinations for rich Chinese, thanks to several factors such as its outstanding education options – seven of the top 25 world universities are in the UK7 – as well as lifestyle prestige.

Find out 4 reasons that make the UK a compelling choice for Chinese buyers.

The Chinese have so much faith in the UK’s prospects and bankability that even in the face of Brexit, Peking University – China’s premier educational establishment – recently invested $11.9 million on a UK campus close to Oxford in March 2017.8

3 reasons why Brexit is winning Chinese over

Why are Chinese relatively unfazed by Brexit, and the uncertainties and speculations around it?

We dig beyond the existing aspects that already make the UK such a darling with Chinese homebuyers, and share 3 extra factors that may explain why Brexit has not dampened demand and interest from mainland property investors.

#1 Brexit to bring closer ties between UK and China

The UK is becoming more China-friendly, and not just in terms of visas. The UK government is incredibly receptive towards Chinese investment, and (as mentioned above) the sterling’s devaluation has made the UK – and Brexit – an excellent business opportunity for the Chinese government and Chinese investors alike.

In fact, Chinese UK Ambassador Liu Xiaoming recently stated China’s desire to be at the front of the queue to make trade and investment deals with the UK post-Brexit9, and these words are turning into action – the UK government recently approved plans for a Shanghai-London Stock Connect, a major step forward in connecting China’s financial markets with those of the UK.10

Furthermore, with Britain set to leave European Union (EU) once the Brexit negotiations are done, China would be a likely choice for the UK government to choose as a new ally, seeing as it’s currently the second-largest economy in the world.

#2 UK passport may retain EU visa-free access

Brexit may mean a new trading relationship between the UK and EU, but recent policy news suggests that UK citizens may be able to retain visa-free access to the EU, and continue to enjoy borderless travel in the EU.

EU senior Brexit negotiator Guy Verhofstadt is advocating for plans to let UK nationals to keep EU citizenship after Brexit.11

Considering passport power is one aspect that is heavily favoured by Chinese investing overseas, the UK passport will remain quite attractive to Chinese seeking to invest in the UK’s investment immigration programme, should this push by Verhofstadt go through.

#3 Loan interest and tax rates remain attractive, even post-Brexit

Unlike Australia and New Zealand, there has been no news of tougher lending measures for foreign buyers from banks in the UK.

Speculations ran rife for a while that Brexit would lead to the emergence of bank loan restrictions, but that has yet to actually happen, and this has lent an additional surge of confidence for Chinese buyers, as they would still be able to apply for loans with continued low interest rates in the UK.

Furthermore, asides from the 3% SDLT surcharge that is imposed for all property buyers in the UK, regardless of domestic or foreign buyers, the UK has not unleashed any tax surcharges on foreign property buyers.

When compared with foreign buyer taxes as much as 30% in Hong Kong, 15% in Singapore, 15% in Canada’s British Columbia (BC) and Ontario, as well as tax surcharges ranging between 3%-7% in different parts of Australia, it’s clear that the UK is a pretty sweet deal for international buyers, and Chinese homebuyers know this.

Brexit = buying opportunity for Chinese

Beyond the abovementioned factors, let’s not forget that although London ranks as one of the world’s great cities, the UK has a wealth of alternative investment destinations – Brighton, Bath, Oxford, Cambridge, Manchester, and Edinburgh – and that means plenty of attractive investment choices for Chinese buyers, who have shown a penchant for investing further afield if it means better yields and returns.

All these factors add up to render the UK a highly attractive investment proposition in the eyes of property investors from China, so it’s no wonder that many Chinese buyers have remained rather unperturbed about investing in the UK with Brexit on the horizon.

Seeing as Chinese investment in the UK hit $47.1 billion between 2010 and 2016, as well as the marked increase in Brexit-inspired Chinese interest and investment in the UK, it’s a pretty safe bet to say that China’s growing market of internationally-minded property investors are increasingly considering Brexit as a good buying opportunity instead.

Sources: 1. Heritage Foundation: Global Investment Tracker; 2. SCMP: China Vanke buys office building in London for £115 million; 3. China Daily: China Minsheng buys Societe Generale's London HQ; 4. Juwai IQ Data; 5. Bloomberg: IMF lifts forecast for U.K. economy in 2016 despite Brexit; 6. Guardian: Britain will be fastest growing G7 economy this year, says IMF; 7. Times Higher Education: World University Rankings 2017; 8. SCMP: Prestigious Chinese university to open campus in Oxford; 9. Daily Telegraph: Brexit makes China keener to strike a trade deal with Britain; 10. Finextra: London Shanghai Stock Connect gets green light; 11. The Guardian: Brexit talks to include plan for UK nationals to keep EU citizenship

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

2024 © Juwai. All Rights Reserved Privacy Policy | Terms of Service