You've successfully copied this link.

10 ways Chinese investors are dominating cleantech

By Juwai, 21 February 2012

You’ve heard it off and on throughout 2011 and 2012: Chinese investors and the Chinese government are starting to aggressively fund U.S.-based cleantech startups from electric vehicle companies to clean power developers. Katie Fehrenbacher reports for GigaOM.

February 20, 2012 -- There’s been a half dozen of these deals in recent weeks and months, so I thought I’d put together this list to point out the 10 big ones I’ve noticed:

1). GreatPoint Energy and China Wanxiang Holdings: At one point GreatPoint Energy, a company that converts coal into cleaner-burning natural gas, had an investor list that was led by the who’s who of Silicon Valley’s greentech ambitions, including Kleiner Perkins, Advanced Technology Ventures, Draper Fisher Jurvetson, and Khosla Ventures. But according to DowJones Venture Wire last week, GreatPoint Energy has now developed a $1.25 billion partnership with industrial parts supplier China Wanxiang Holdings, including a $420 million Series D equity investment.

The article calls the deal “the largest ever by a Chinese corporation into a venture-capital-funded U.S. company.†GreatPoint Energy will use the money partly to build a large-scale plant in China to convert coal into natural gas using GreatPoint’s process called hydromethanation.

1). GreatPoint Energy and China Wanxiang Holdings: At one point GreatPoint Energy, a company that converts coal into cleaner-burning natural gas, had an investor list that was led by the who’s who of Silicon Valley’s greentech ambitions, including Kleiner Perkins, Advanced Technology Ventures, Draper Fisher Jurvetson, and Khosla Ventures. But according to DowJones Venture Wire last week, GreatPoint Energy has now developed a $1.25 billion partnership with industrial parts supplier China Wanxiang Holdings, including a $420 million Series D equity investment.

The article calls the deal “the largest ever by a Chinese corporation into a venture-capital-funded U.S. company.†GreatPoint Energy will use the money partly to build a large-scale plant in China to convert coal into natural gas using GreatPoint’s process called hydromethanation.

2). Smith Electric Vehicles and Wanxiang Group: GreatPoint Energy isn’t the only one that’s teamed up with Wanxiang. I reported last week that electric car company Smith Electric Vehicles is in the process of raising $40 million from private investors. And days after that article, Smith announced that Wanxiang Group has signed a letter of intent for a $25 million equity investment into Smith and an up to a $75 million investment in a JV between Smith and Wanxiang to make electric school buses and commercial vehicles.

Smith filed for an IPO in November 2011. The company sells electric trucks and vans for companies’ fleet operations and counts customers like Coca-Cola, Fed-Ex, Staples, and Sainsburys, as well as the military.

2). Smith Electric Vehicles and Wanxiang Group: GreatPoint Energy isn’t the only one that’s teamed up with Wanxiang. I reported last week that electric car company Smith Electric Vehicles is in the process of raising $40 million from private investors. And days after that article, Smith announced that Wanxiang Group has signed a letter of intent for a $25 million equity investment into Smith and an up to a $75 million investment in a JV between Smith and Wanxiang to make electric school buses and commercial vehicles.

Smith filed for an IPO in November 2011. The company sells electric trucks and vans for companies’ fleet operations and counts customers like Coca-Cola, Fed-Ex, Staples, and Sainsburys, as well as the military.

3). Bridgelux and Kaistar: California-based LED lighting startup Bridgelux announced last week that it’s getting $25 million from Kaistar, a joint venture between two public Chinese companies, Epistar and Kaifa. Bridgelux plans to use the funds for research, development and manufacturing of LED chips and packaging for light fixtures.

Bridgelux had already raised a massive $220 million in private funding and in previous years Bridgelux was on the short list for an IPO.

4). LanzaTech and Chinese steel and coal companies: LanzaTech uses microbes and fermentation to convert the carbon monoxide from waste gas from industrial operations and other sources into biofuels and chemicals. Founded in 2005, LanzaTech originally hailed from New Zealand and in recent years has started building demonstration projects in China.

LanzaTech is already working with two Chinese steel manufacturers – Baosteel and Capital Steel — to turn waste gas from their operations into ethanol. LanzaTech said it has installed equipment for a demonstration plant at Baosteel and plans to start production later this year. Last November, the biofuel company also announced a plan to work with a large Chinese coal producer – Yankuang Group — to produce fuels and chemicals from synthesis gas produced by Yankuang’s gasification equipment.

3). Bridgelux and Kaistar: California-based LED lighting startup Bridgelux announced last week that it’s getting $25 million from Kaistar, a joint venture between two public Chinese companies, Epistar and Kaifa. Bridgelux plans to use the funds for research, development and manufacturing of LED chips and packaging for light fixtures.

Bridgelux had already raised a massive $220 million in private funding and in previous years Bridgelux was on the short list for an IPO.

4). LanzaTech and Chinese steel and coal companies: LanzaTech uses microbes and fermentation to convert the carbon monoxide from waste gas from industrial operations and other sources into biofuels and chemicals. Founded in 2005, LanzaTech originally hailed from New Zealand and in recent years has started building demonstration projects in China.

LanzaTech is already working with two Chinese steel manufacturers – Baosteel and Capital Steel — to turn waste gas from their operations into ethanol. LanzaTech said it has installed equipment for a demonstration plant at Baosteel and plans to start production later this year. Last November, the biofuel company also announced a plan to work with a large Chinese coal producer – Yankuang Group — to produce fuels and chemicals from synthesis gas produced by Yankuang’s gasification equipment.

5). PowerGenix and China City Construction Corps: San Diego-based PowerGenix spent the past year hunting for a partner in China and announced in January that it’s forming a joint venture with China City Construction Corp. to produce its nickel-zinc batteries for the so-called microhybrid vehicles. By the end of this year, the joint venture, called CCCC-PowerGenix Clean Energy Co., plans to set up a factory to produce 400,000 batteries per year, or 200,000 watt-hours total.

5). PowerGenix and China City Construction Corps: San Diego-based PowerGenix spent the past year hunting for a partner in China and announced in January that it’s forming a joint venture with China City Construction Corp. to produce its nickel-zinc batteries for the so-called microhybrid vehicles. By the end of this year, the joint venture, called CCCC-PowerGenix Clean Energy Co., plans to set up a factory to produce 400,000 batteries per year, or 200,000 watt-hours total.

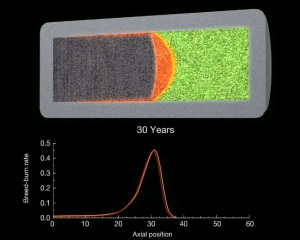

6). TerraPower and the Chinese government: Nuclear startup TerraPower doesn’t have an official deal to build a reactor with China’s National Nuclear Corporation (despite media reports), but TerraPower investor Bill Gates (yes that Bill Gates) says that TerraPower is having preliminary discussions with the Chinese government over its nuclear tech.

TerraPower is developing nuclear traveling wave reactor technology, which is a relatively new type of small nuclear reactor design that can use the waste byproduct of the enrichment process, or waste uranium, for fuel. TerraPower’s backers have long said it will likely commercialize its technology first outside the U.S.

7). Brammo and the Hong Kong government: Electric motorcycle maker Brammo says it’s scored a deal to supply the Hong Kong government and police force with its electric motorcycles. Brammo says the Hong Kong government will replace its existing gas-powered motorcycle fleet with Brammo’s Enertia.

Hong Kong’s Water Supplies Department will use the Enertia Plus, while the Hong Kong police department will use the 2012 Enertia Plus “LE,†or the Law Enforcement edition, which has features for police. Brammo’s exclusive dealer in Hong Kong is JCAMAdvanced Mobility Company.

6). TerraPower and the Chinese government: Nuclear startup TerraPower doesn’t have an official deal to build a reactor with China’s National Nuclear Corporation (despite media reports), but TerraPower investor Bill Gates (yes that Bill Gates) says that TerraPower is having preliminary discussions with the Chinese government over its nuclear tech.

TerraPower is developing nuclear traveling wave reactor technology, which is a relatively new type of small nuclear reactor design that can use the waste byproduct of the enrichment process, or waste uranium, for fuel. TerraPower’s backers have long said it will likely commercialize its technology first outside the U.S.

7). Brammo and the Hong Kong government: Electric motorcycle maker Brammo says it’s scored a deal to supply the Hong Kong government and police force with its electric motorcycles. Brammo says the Hong Kong government will replace its existing gas-powered motorcycle fleet with Brammo’s Enertia.

Hong Kong’s Water Supplies Department will use the Enertia Plus, while the Hong Kong police department will use the 2012 Enertia Plus “LE,†or the Law Enforcement edition, which has features for police. Brammo’s exclusive dealer in Hong Kong is JCAMAdvanced Mobility Company.

8). Silevo and Chinese venture firms: California startup Silevo is building a hybrid solar cell design that uses single-crystal silicon as the base layer on which it adds a “tunneling oxide layer†and a layer of amorphous silicon to alter the voltage and current of the cells. Silevo raised $55 million in venture capital from investors, including three China-based firms: DT Capital (affiliated with Madrone Capital), NewMargin Ventures, and GSR Ventures (connected to Mayfield Fund).

Silevo is in the process of building a 30 MW factory in Hangzhou, China, and expects to bring the factory into full production modeduring the first quarter of 2012. The company plans to add another 200 MW in 2013 if demand is there.

8). Silevo and Chinese venture firms: California startup Silevo is building a hybrid solar cell design that uses single-crystal silicon as the base layer on which it adds a “tunneling oxide layer†and a layer of amorphous silicon to alter the voltage and current of the cells. Silevo raised $55 million in venture capital from investors, including three China-based firms: DT Capital (affiliated with Madrone Capital), NewMargin Ventures, and GSR Ventures (connected to Mayfield Fund).

Silevo is in the process of building a 30 MW factory in Hangzhou, China, and expects to bring the factory into full production modeduring the first quarter of 2012. The company plans to add another 200 MW in 2013 if demand is there.

9). Boston-Power and the Chinese government: Boston-Power, a lithium-ion battery maker, raised $125 million in venture capital and Chinese government incentives to move its manufacturing base to China. Boston-Power plans to build a lithium-ion battery cell factory near Shanghai and a technology center in Beijing where its staff will work with customers to integrate Boston-Power’s cells into electric drivetrains.

10). Sunpreme and Chinese investors: Solar cell maker Sunpreme raised roughly $50 million in a series B round to build a factory in Jiaxing, China. Investors include International Finance Corp. (part of the World Bank Group), Capricorn Investment Group and China Environmental Fund III (managed by Tsing Capital in China).

Images courtesy of Boston-Power, Silevo, Dainis Matisons, PowerGenix, Bridgelux, Smith Electric Vehicles and GreatPoint Energy.

9). Boston-Power and the Chinese government: Boston-Power, a lithium-ion battery maker, raised $125 million in venture capital and Chinese government incentives to move its manufacturing base to China. Boston-Power plans to build a lithium-ion battery cell factory near Shanghai and a technology center in Beijing where its staff will work with customers to integrate Boston-Power’s cells into electric drivetrains.

10). Sunpreme and Chinese investors: Solar cell maker Sunpreme raised roughly $50 million in a series B round to build a factory in Jiaxing, China. Investors include International Finance Corp. (part of the World Bank Group), Capricorn Investment Group and China Environmental Fund III (managed by Tsing Capital in China).

Images courtesy of Boston-Power, Silevo, Dainis Matisons, PowerGenix, Bridgelux, Smith Electric Vehicles and GreatPoint Energy.