亚洲新闻

- 主页

- 新闻

- 亚洲新闻

You've successfully copied this link.

Chinese wealth: Understanding the latest trends

China’s dynamic economic boom has spawned legions of Chinese millionaires and billionaires, giving birth to the hot topic of family wealth and business succession.1

How rich is China?

How rich is China?

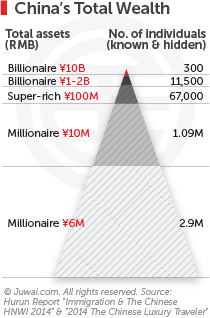

Hurun Report estimates China’s staggering wealth to consist of around 11,800 Chinese billionaires,7 67,000 super-rich (10 million or more), and 3.99 million dollar millionaires.2

Amazingly, some 89% of Chinese billionaires are self-made.3

Most are nouveau riche – or as the Chinese say, “TÇ” háo” (土豪) – who built their wealth in the recent two to three decades.

However, instead of keeping it in the family – like other Asian business mogul empires in Hong Kong or Taiwan still tend to do – more Mainland Chinese tycoons are starting to adopt the Western standard of selling off their businesses or hiring other professionals to take over management.4

Societal & cultural factors

As modern-day Chinese increasingly embrace international and Western ideologies, we can observe other cultural and societal drivers as well.

While Asian parents traditionally expect their children to become their business successors, three decades of one-child policy has fostered a new ethos.

They recognise the chances of finding a business heir with the right business acumen and leadership skills within the family may be difficult.

Also, with many influenced by study abroad experiences, younger Chinese generations aspire to forge their own path. Rather than force a square peg into a round hole, Chinese parents are increasingly happy to offer freedom of choice to their only child.

Thus, the concept of selling their business for a pretty profit is more appealing than giving truth to the common Chinese adage of “Family wealth never lasts more than three generations” – whereby many third-generation scions have been known to have squandered away the family fortune.

Generational investment & legacy home purchases

Generational investment & legacy home purchases

Nevertheless, the fading tendency to keep the business in the family does not mean Chinese business owners do not keep family wealth in the family, or make investments based on generational benefit.

Generational driven investment is precisely the kind of investment Chinese buyers make.

They simply prefer to pass other forms of legacy to their children – in particular, investing in property as inheritances for generations to come.

15% of wealthy Chinese with US$10 million (that’s over 10,000 millionaires!) allocate 60% of their total assets to property investments,2 and 93% of China’s wealthy are more likely to make a legacy home purchase worth US$1 – US$3 million for the family.5

This unique investment mindset tells us a lot about the Chinese buyer, and with the immense amount of investment up for grabs, real estate agents better not dismiss Chinese buyers as merely a flash in the pan because clearly, they’re here to stay.

Sources: 1. SCMP; 2. Hurun Report “Immigration & The Chinese HNWI 2014”; 3. Wealth-X and UBS Billionaire Census 2013; 4. SCMP; 5. Sotheby’s International Realty “Luxury Lifestyle Report”; 6. Wealth-X News; 7. Hurun Report "2014 The Chinese Luxury Traveler"

喜欢这篇文章?免费注册,获取居外亚洲市场的最新资讯!

排序

- 2025

- 2023

- 2022

- 2021

- 2020

- 2019

- 2018

- 2017

- 2016

- 2015

- 2014

- 2013

- 2012

标签

- australia

- china

- chinese buyers

- investment

- juwai

- property

- real estate

- residential

- united kingdom

- united states

Thank you for subscribing to Juwai News!

Sign up for a Juwai Account now for free to enjoy FREE download access to country-specific reports on Chinese property investments.

Do you want to sign up now? Or continue if you have already signed up or you will do it later.