You've successfully copied this link.

Chinese property investors are eyeing German real estate again

After being praised for its quick response to the pandemic crisis, Germany is back on Chinese property investors’ radar.

Chinese cross-border property investors who are searching for calm in the coronavirus storm are looking at Germany as a destination to make "pandemic-proof" investments for the future.

Like other countries hit by COVID-19, China’s economy suffered greatly over the course of the outbreak. Now that China has largely gotten the virus under control and the economy has mostly re-opened, cash-rich Chinese are scouring the globe again to buy property at prices well below those of pre-COVID-19 days as asset prices fall due to the pandemic, say industry watchers.

And Germany is catching the eye of Chinese buyers again.

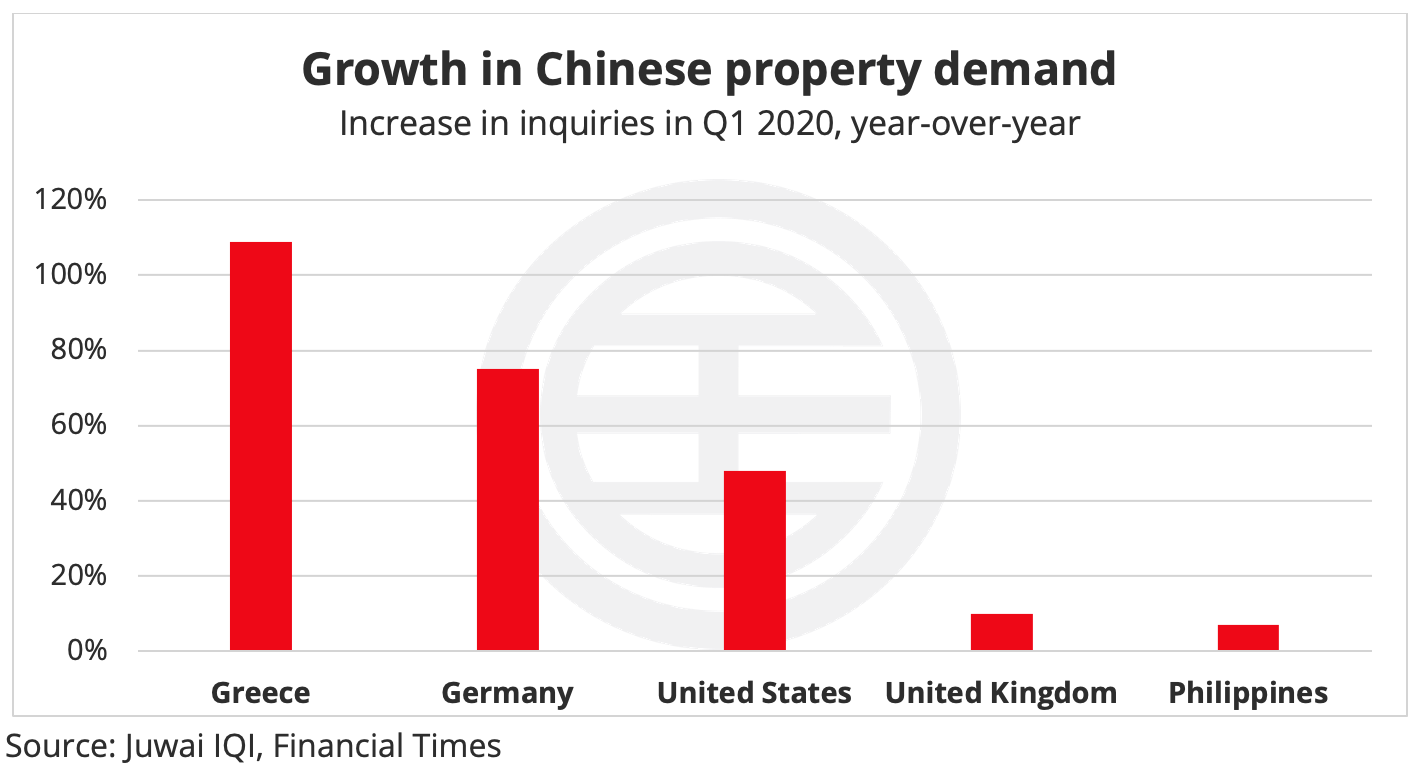

During the months from February to March, Juwai’s data showed enquiries for German properties rose by 34%. And for Q1, 2020, after Greece, Germany came in second in rankings for most-enquired destination, registering a 75% increase in enquiries compared to the year before.

Here are some reasons why the Chinese see Germany real estate as stable investments

High returns and good prospects

One of the many reasons why Chinese buyers prefer to invest in Germany is its potential to offer investors high returns from commercial and buy-to-let property if buyers take a long-term view.

In April this year, Deutsche Bank Research released a report on how the COVID-19 crisis might impact German real estate. The report forecasted that “many households may move into crisis mode and focus on securing their jobs and livelihood. That means that they will be less willing to move or to buy a home, which is why overall demand for residential space will probably shrink considerably in the short term.”1

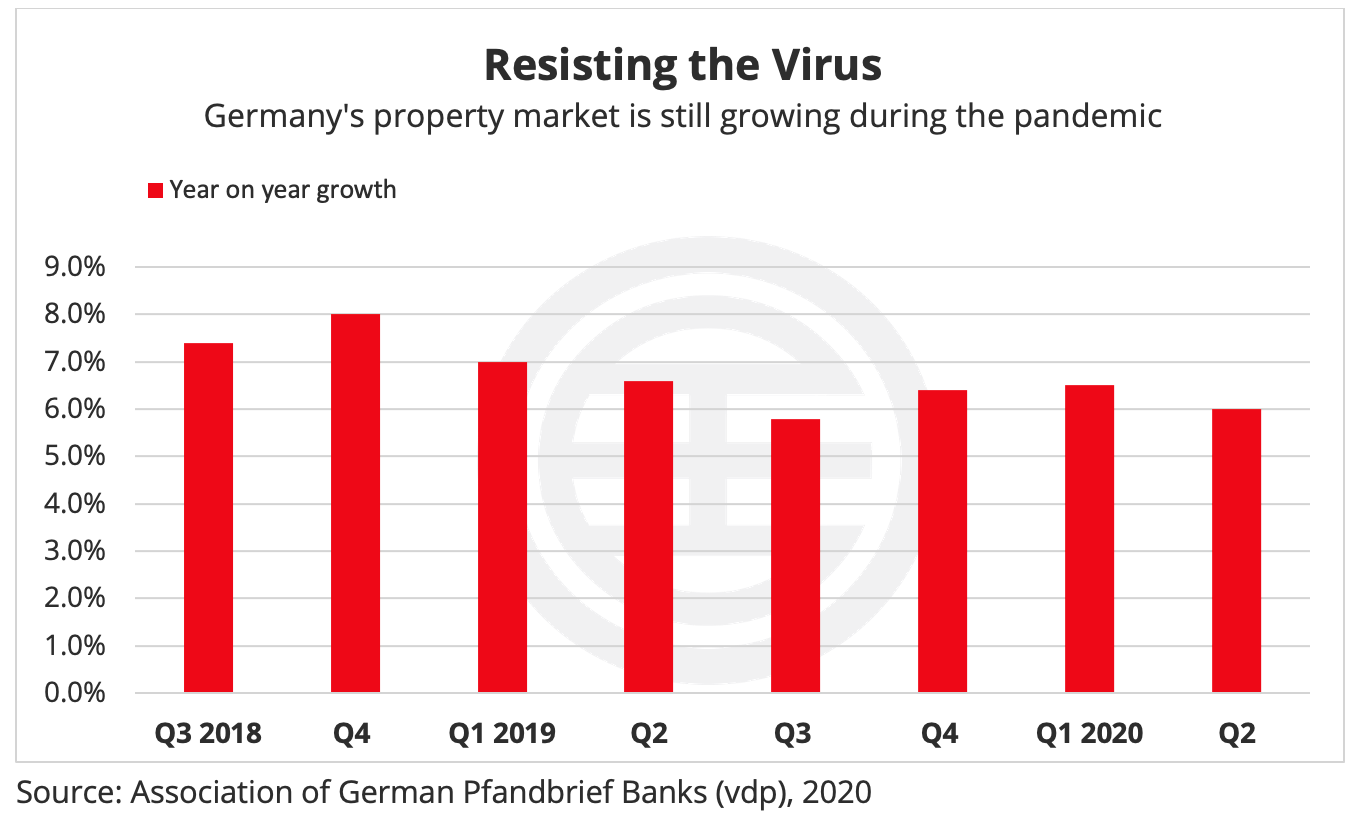

However, the German housing market is able to shrug off pandemic woes and stays buoyant. Home prices unexpectedly rose in the second quarter despite an economic slump and anti-virus measures such as social distancing and travel bans which complicated transactions. According to data compiled by the Association of German Pfandbrief Banks, or VDP, prices increased by 6% from a year earlier. That compares with an annual gain of 6.5% in the January-to-March period dispels the prediction by some people that market will suffer a price drop, stated a Bloomberg report.2

Yet despite these dramatic price increases, the purchase of real estate is still worthwhile, according to market watchers, because in many cities and districts in Germany, the price of a property is still less than 25 times the annual rent.3

German residential properties currently offer an average rent yields of approximately 4% per annum4 and will appear more attractive to Chinese investors who can only expect average rent yields of 2.1% back home.5

China's growing middle class is also searching for investment opportunities. But at home, prices have skyrocketed, with centrally located apartments in Beijing and Shanghai selling at more than €10,000 per square metre, in some cases as much as €15,000 to €18,000 euros.6 German prices, by contrast, are a cheap bargain. Besides, in cities like Shanghai and Beijing, families are permitted to buy real estate only for their own use. As such, investors will search for alternatives.

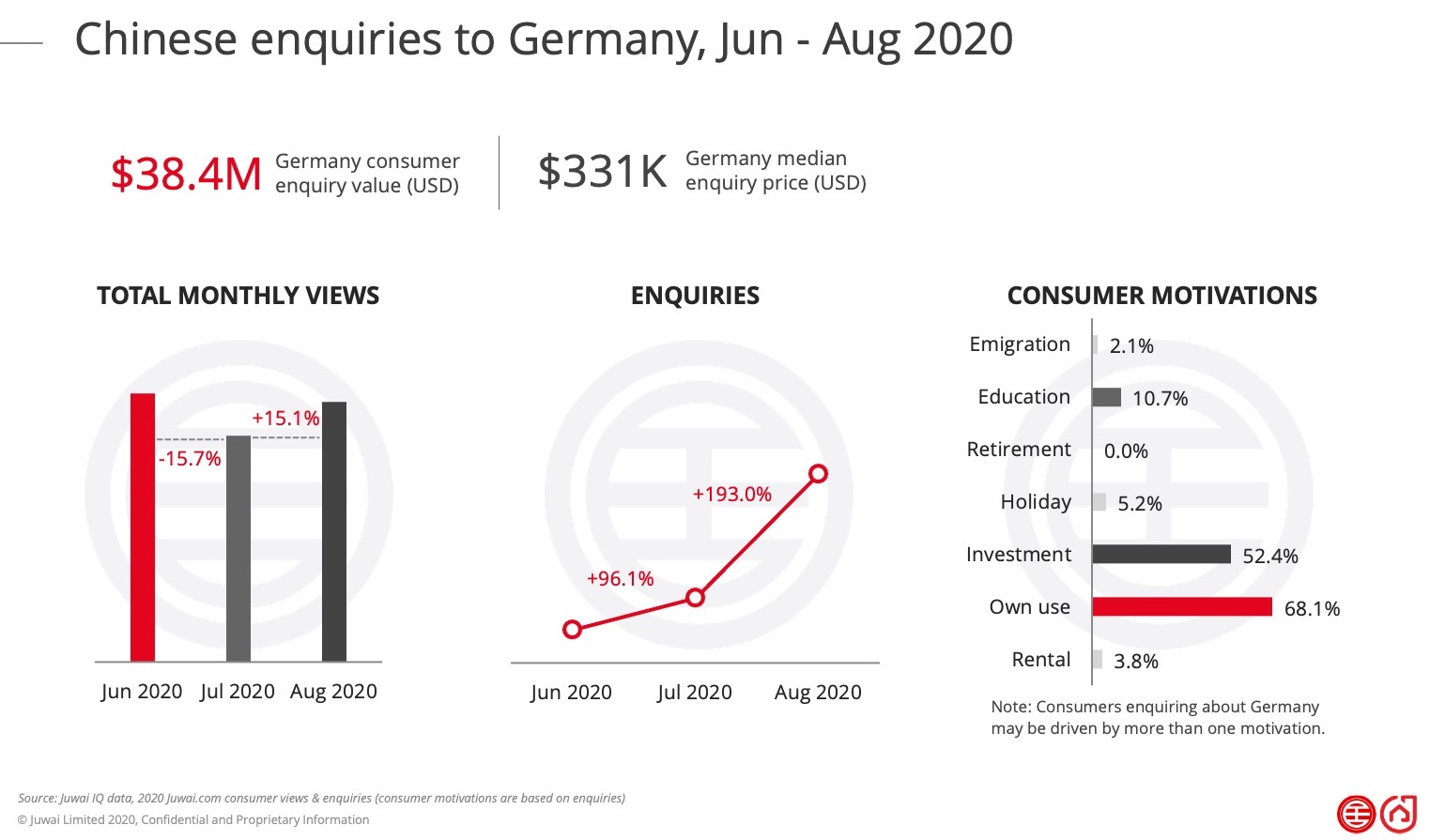

At Juwai.com, enquiries rose 96.1% from June to July and then surged another 193.0% from July to August.

Better mitigation of COVID-19

Compared to other countries in the Eurozone, Germany’s proactive measures to slow the spread of the coronavirus has given the country a positive image even though it has yet to fully contain the contagion.Germany has coped with the coronavirus pandemic better than most countries in Europe.

For many foreign property investors, Germany’s widescale testing and its fast response to the outbreak which has helped keep its Covid-19 mortality rate low has highlighted the country’s appeal: a generous and accessible healthcare system, effective political leadership and a stable society. Everything seems more orderly in the country, say residents who compare their situation to what’s going on in other countries such as the UK.7

This reassures Chinese buyers that the country has a strong health security system which in turn boosted their confidence to invest in the country.

Financing is available

There are no restrictions on foreigners purchasing German real estate, regardless of their country of origin. The maximum amount one can borrow, however, does depend on your residency status. German residents can borrow up to 80% of the assessed value of the property, but non-residents can be limited to approximately 55% to 60% of the assessed value. Borrowers just need to make sure they have an annual income in excess of €20,000. What’s more, monthly mortgage payments can never exceed 35% of your monthly income.9

Germany has top-notch education

It’s a well-known fact that Chinese tend to buy properties where their children are studying. Germany is among the top 10 most popular study destinations in the world and its popularity among ambitious international students is increasing every day especially with the Chinese. It currently ranks fourth after the UK, the US, and Canada respectively, according to the World Population Review for best countries for education.10

China currently makes up 13.2% of Germany’s international student body, with 39,871 Chinese citizens studying in the country and is the largest distributor of international students at German universities.11

Chinese students are attracted to the country efficient educational system which offer some of the best universities in the world, and free or very low tuition fees, and numerous job opportunities after graduation.

Germany’s popularity among Chinese students is further amplified by its early response in dealing with Covid-19. For higher education overseas, Chinese parents prefer to send their children to countries with good health security systems.

Juwai’s database shows that between and August this year, 2.1% of enquiries indicated that education is one of the reasons for property hunting in Germany while 68.1% indicated they are looking for homes for own use.

These two motivations normally co-relate. Experts say Chinese buyers may be looking for investment opportunities when buying foreign properties but in the back of their minds, it is about educating their kids abroad.

Cities favoured by Chinese

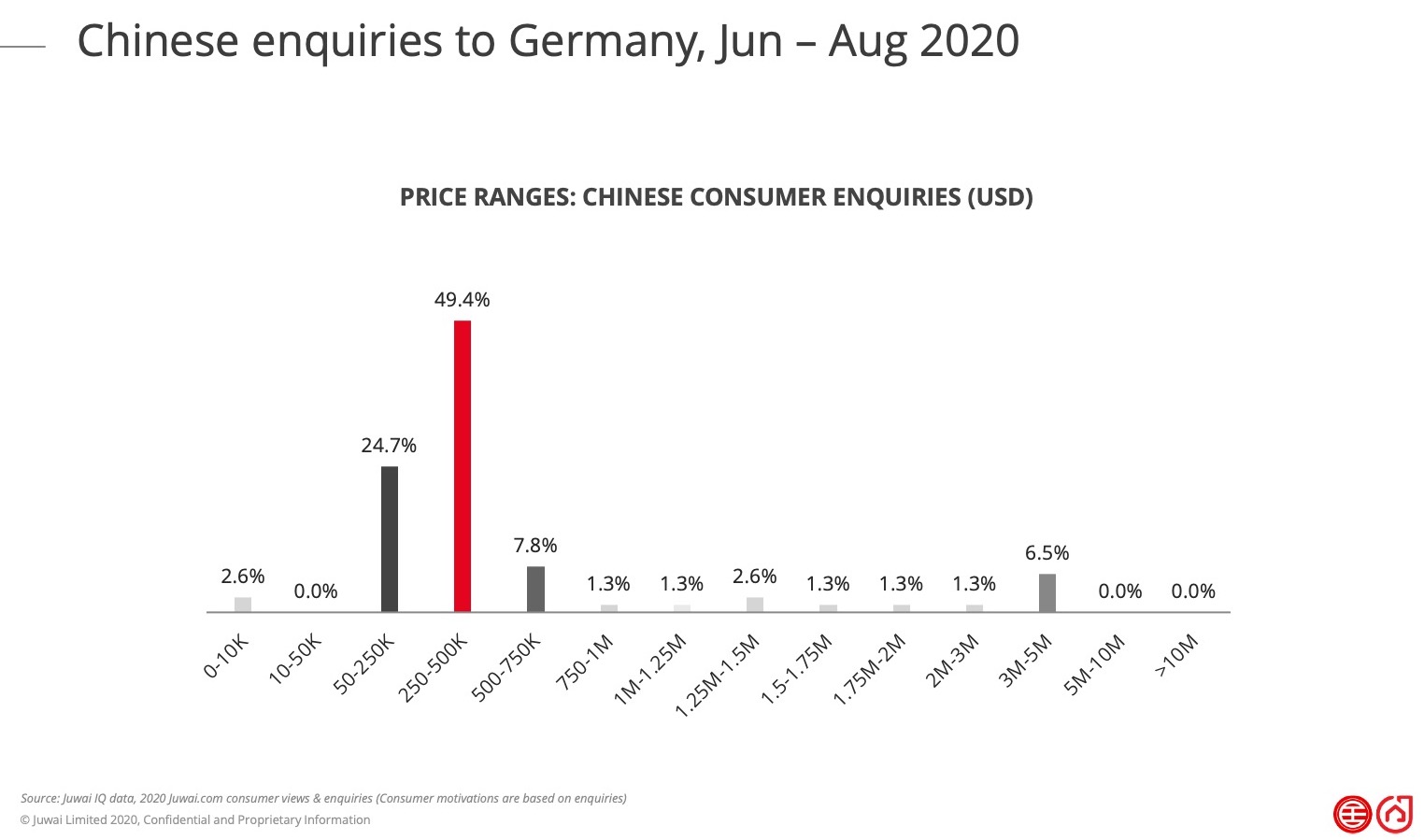

In Germany, the prime targets favoured by Chinese are Frankfurt, Berlin, Hamburg and Munich. According to media reports, some brokers are already specialised in dealing with Asian customers. Queries by Chinese customers had more than doubled over the past four years, according to agents. Many are interested in one- or two-room apartments ranging between €250,000 and €400,000.12

At Juwai.com, most enquiries were looking for property within the USD250K to USD500K bracket.

Quality lifestyle

Germany is also the most admired country in the world for the third year running, according to the annual leadership Gallup poll.13 This indicates the country’s stable and strong government which is a big draw for investors. The country also offers a contemporary lifestyle, temperate climate and the Chinese have always admired Germany’s attitude to life and its respect for tradition, history and humanity.

Overall, all these factors have contributed to Germany’s appeal to Chinese cross-border property buyers.