You've successfully copied this link.

5 ways the middle-class is powering China's future

$6.5 trillion – that’s how much the China’s middle-class consumer market will be worth by 2020.1

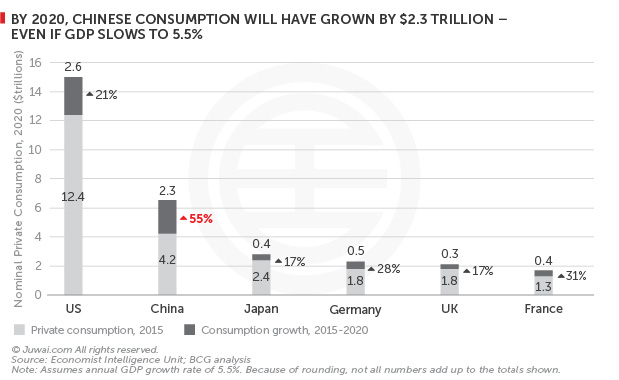

Driven by a $2.3 trillion increase in consumption by China’s middle-class between now and 2020, China’s consumer spending is projected to outstrip developed markets by 2020 – surpassing expected growth in the US, Japan, Germany, the UK, and France.

More astonishingly is the fact that this is slated to happen, even if China’s GDP slows to 5.5%.

The world’s largest consumer market by 2020

By 2020, China will reign as the biggest consumer market in the world.

According to Boston Consulting Group (BCG)2, China’s vast and rapidly-growing middle-class (earning more than $15,600 p.a.) is estimated to have totalled 298 million households in 2015.2

Fast-forward another five years, and China's middle-class is projected to swell to 338 million households by 2020, charting a 13.4% increase.2

In comparison, the US – the world’s largest consumer market – had a total of 124.6 million households across all class demographics in 2015.3

So in the case of China’s middle-class, we are clearly talking about something significant.

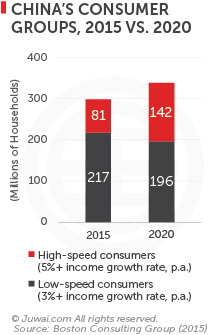

In fact, by delving deeper into the numbers, BCG reckons the most significant growth will come from China’s class of ‘high-speed’ consumers (earning more than $22,800 p.a. and seeing 5%+ annual income growth) whose population will grow from 81 million in 2015 to 142 million in 2020, an increase of 75%.

How China’s middle-class driven future is a five-horse carriage

We see the middle-class story as a five-horse carriage, driven by five distinct, powerful, and persistent forces that have to be factored into a go-to-market business strategy for China:

#1 Inland regions: the new growth frontier

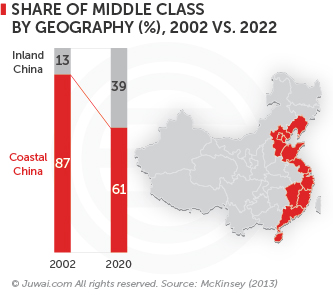

As China urbanises and businesses increasingly migrate inland from coastal cities, so inland regions will see a surge in their population of middle-class households.

As China urbanises and businesses increasingly migrate inland from coastal cities, so inland regions will see a surge in their population of middle-class households.

McKinsey estimates that the share of China’s middle-class living in inland regions will grow from 13% in 2002, to 39% in 2022.4

What this means is that more and more lower-tier cities will rise as hotbeds of business and consumer activity, as middle-classes emerge in fast-developing cities away from China’s main business hubs of Shanghai, Beijing, and Guangzhou.

Prime examples would be second- and third-tier locations, such as Kunming and Hefei.

#2 Online: China’s dominant sales channel

#2 Online: China’s dominant sales channel

620 million out of China’s 668 million netizens are mobile internet users – 90% who surf the net via smartphones and mobile devices.5

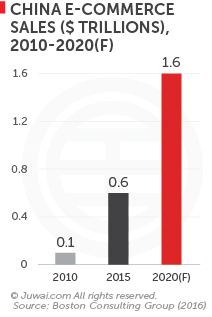

This is significant because the trinity of wider internet usage, increased adoption of smartphones, and swifter product delivery in China will see its e-commerce account for $1.6 trillion in online sales in 2020.1

That's a 267% increase compared with $600 billion worth of online transactions recorded at the end of 2015!1

And once again, it’s the middle-classes – those comfortable with credit card purchases, affluent enough to spend, and busy in their professional lives – who will form the core of China’s online consumer market.

#3 China's young big-spenders

China’s younger generations who are aged between 18 and 35 are increasingly becoming internationally-minded and tech-savvy. This, in turn, will help form the core of China’s future consumer base, accounting for 53% of total private consumption in 2020 in comparison with the 43% of now.1

Put simply, these age groups have grown up amid prosperity, and aren’t as frugal as older generations.

Consumers aged between 18 and 35 are spending 14% more per year, on average – twice the pace of consumers over 35.1

Also, these consumers are comparatively more sophisticated, as they are more likely to have had an international education, plus a longer exposure to brands and consumer culture in both China and around the world.

#4 The 50+ demographic: a 528 million-strong market by 2025

Yes, younger consumers spend more but their share of the population will decline in the years ahead as China ages and older age groups account for a larger share of the market.

By 2025, the population aged over 50 years will account for 38% of the population or a total of 528 million people, compared with 24% and 328 million in 2010, according to the World Bank.6

While this may mean that the labor force will shrink, it also means that a much larger market for companies with products targeting the older population. That’s why companies like Vanke, China’s biggest real estate developer, are investing heavily in properties to market to the older generation.7

After all, it’s these segments of the population that are sitting on vast amounts of savings8, having built them up during China’s early boom years when the one-child policy was in effect.

With expansion in healthcare and pension systems, as well as China’s new two-child policy, savers will have less reason to horde money and more options on which to spend, thus increasing the sales potential from this growing demographic group.

#5 Internationally minded + increasingly connected Chinese

2015 witnessed a record-breaking 120 million tourists from China heading overseas, while 2016 is expected to see 139.2 million Chinese embarking on trips abroad.9

Together with increasing air, rail, and sea connections between China and the rest of the world; easier visa procedures for international travel; and China’s growing corporate footprint, it will become more commonplace for Chinese citizens to travel out of China, whether for work, studies or play.

With only about 4% of China’s population are passport bearers, a percentage that Goldman Sachs expects will grow to 12% in ten years time, this is one segment worth keeping an eye on for sure – especially as Chinese tourism has been known to propel international property investments.

The consumer target of the 21st Century

Already, the world’s largest MNCs are rooted to this demographic and enjoying their slice of the pie, thanks to their focus on China’s middle-class consumer story:

- Apple: The world’s top consumer company booked revenues of $60.9 billion in the Greater China region in 201510 – a 61.9% growth y-o-y that makes China the fastest growing region for the company’s sales in the world.

- Mercedes Benz: The oldest luxury car firm in the world saw mainland sales total 386,634 units in 2015, up 29.1% y-o-y11, making it the company’s largest market globally.

- Uniqlo: Part of the giant Japanese Fast Retailing empire, Uniqlo has steadily built a solid market share in China, taking a 1.6% share of the specialised retail market and eclipsing established brands like Zara and H&M. The company reported a 46% y-o-y increase in revenues between August 2014 and August 2015.12

Ultimately, with a potential consumer market of around 270 million households worth a whopping $6.5 trillion, this is one market that you just can’t afford to miss.

3 quick tips to marketing better to Chinese

While tackling the China market may be as daunting as it is enticing, remember that there are lots of routes to success. Here are three pointers to help you improve your China strategy:

For starters, build an online presence and try to focus one or more of the trends outlined above. If you want to target the growth potential of inland regions, look at search trends and find out what properties buyers in second-and third-tier cities are looking at, and match your offering to that market.

In the case of older generations, consider both the importance of generational investment to Chinese buyers, and the growing potential for retirement-related property investment from China’s increasing 50+ population.

Alternatively, tailor your offering to the younger market, who are obsessed by overseas education at top universities, and are increasingly aspiring to both an international lifestyle and a globe-hopping career trajectory.

It’s subsectors like these that will not only constitute a $6.5 trillion consumer economy, but what’s been estimated as a potential $661 billion outflow of property investment from mainland China into overseas properties over the coming years.

With stakes as high as these, and with the tools available for you, this is a market opportunity that is simply too good to pass up.