You've successfully copied this link.

6 tips to boost your China strategy in 2017

Worth $4.9 trillion, China’s retail market is now the largest and possibly most lucrative market in the world.1

It’s no wonder that competition for a piece of the fast-burgeoning Chinese market has heat up, with players both big and small chasing pell-mell for a share of it. Take Alibaba, China’s leading retailer, for example.

At the end of 2015, Alibaba had more than 8.5 million sellers across its three platforms – Taobao, Tmall, and Juhuasuan2 – whose combined efforts generated a whopping ¥3 trillion ($462 billion) in sales during 2015.3

With such fierce competition, China-focused firms are under pressure to differentiate themselves like never before. Luckily, there are many examples of firms who have done so successfully and who are making in-roads into China’s growing retail market, with Samsonite being a stand-out business case.

Samsonite conquers China with a multi-pronged approach

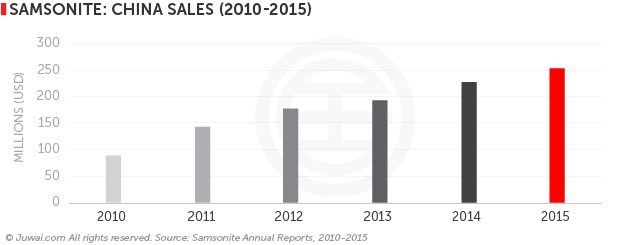

Samsonite quadrupled its sales in China from $88.4 million in 20104 to $256.8 million in 20155 by latching onto the explosive growth in tourism from China and following a nuanced expansion strategy.

For starters, differentiation is an essential part of its business strategy, and Samsonite offers different brands for different market segments.6

Beyond its Samsonite brand, which is targeted at business travellers, Samsonite’s product lines also include high-end Black Label brands, the more affordable American Tourister range, French handbag brand Lipault, and tablet cover brand Speck.7

Online offerings are key, and they feature prominently in Samsonite’s China market strategy. Samsonite has dedicated stores on different platforms like TMall, JD.com, and Amazon China, allowing it to efficiently and cost-effectively beam its offerings into the heart of China’s fast-growing e-commerce market.8

Like all successful China-focused retailers, Samsonite has exploited the value of targeting China’s peak sales seasons as well. A prime example is its 2015 Singles’ Day promotion, which generated a stunning 132% y-o-y increase in sales to hit $4.2 million on the day of the promotion.9

That said, with Samsonite setting such a stellar precedent, it’s time to think how you can emulate its strategy to set your brand apart from the rest, and better capture the attention of China’s growing market of overseas property investors.

6 tips to boost engagement with Chinese buyers

Regardless if you’re a seasoned veteran or still new to the China market here are six tips that will help you leverage Juwai’s multi-functional platform, differentiate your brand, and reap better success with Chinese buyers this 2017:

#1 Drill down with data

China’s overseas property buyers are becoming increasingly diverse, and that makes targeting the right buyer group an intricate task. By having access to detailed data on what kind of buyers are searching, which properties they are seeking, where they are looking in your locale, and the price points they are considering, you can adjust your offerings accordingly and give a more focused offer. To help you better decipher the Chinese market, Juwai constantly offers insights and knowledge into the Chinese market with regular articles, tips, reports, newsletters, and survey findings.

If you're not a subscriber yet, sign up now for our bi-weekly Ni Hao Newsletter to ensure you never miss any of these.

#2 Offer on-the-go access with mobile

With 1.45 billion active smartphone devices calculated in China at the end of Q3 2016, mobile is the dominant channel for connecting with Chinese buyers.10 As such, getting your mobile game up to standard is a crucial step towards conquering the Chinese market. Juwai Mobile App offers Chinese buyers the most intuitive and user-friendly property search experience on the market wherever they are, be it in China or when they are travelling abroad, making it a vital part of your go-to-market mobile strategy for China.

#3 Get active on Chinese social media

35% of all time spent on mobile in China is actually used on WeChat, while 55% of all time on mobile is spent within Tencent products.11 Clearly, social media is massive in China. However, it’s hard to sell to Chinese buyers when your website and usual social media channels – such as Facebook and Twitter – are blocked and invisible to them due to China’s Great Firewall. Be social savvy like these brands who made it big in China by leveraging China's social media apps wisely.

#4 Clarify with the right communication

With over 2.5 million property listings on Juwai.com, your product descriptions have to be precise and notable to capture Chinese buyer attention. While Mandarin may be one of the hardest languages to master, our Juwai in-house communications team can solve that obstacle for you by rapidly and accurately translating your listings into the right language with the right tone and nuances that speaks to prospective Chinese clients. Putting in sufficient information is important as well, so finding out what Chinese buyers look for when property hunting is a must-do.

#5 QR Codes for quick and easy connection

QR codes are a way of life in China because they allow fast and fuss-free access to a wealth of content, ranging from special offers, product information, and reviews. Chinese consumers love them because of their convenience, as well as the option to instantly connect with a seller and receive new updates. Juwai’s platform is in tune with this trend because it offers QR codes for each property listing on the platform, giving potential buyers the lowdown on an offering in a matter of seconds.

#6 Brochures for business

Having a brochure of your property listings in Mandarin is not only handy in getting the right information across to Chinese buyers in the right language, it means you're always ready for any Chinese real estate investors who may roll into your town at any given time. Our downloadable Chinese property brochure function offers you a pre-designed Chinese property brochure for you to print and hand out to your prospective Chinese clients to keep, while an included QR code within the brochure conveniently links back to your listings online.

With property sales curbs being enforced domestically, Chinese appetite for overseas property remains strong, so there is no time like the present to integrate the above 6 tips into your China strategy and set your China plans into action.