You've successfully copied this link.

6 reasons why Tokyo and Osaka are drawing Chinese property investors

Japan has, in recent years, gained favour with Chinese buyers.

Chinese consider Japans as an ideal property investment destination as they grow wearier of traditional hotspots such as the United States, Canada and the United Kingdom due to unpredictable political events and increasing regulations in the real estate industry.

Looking for ways to diversify their holdings elsewhere, Japan seems like a good bet for several reasons. We look at six factors driving Chinese buyers to Japan, with a focus on Tokyo and Osaka.

#1 Improved economic ties

As Washington and Beijing continue to clash over trade and regional security, Japan’s diplomatic relationship with China is experiencing an upswing. Following the 2019 Osaka G20 summit, both countries pledged to improve ties and struck agreements on trade and investments that aimed to smooth long-standing issues regarding territorial disputes and bitterness over wartime history.1

This has encouraged Chinese buyers to have a more positive outlook on Japan as investments ahead of next year’s Summer Olympics in Tokyo and 2025 World Expo in Osaka will see the residential real estate sector sustains income durability and rental uplift. Osaka is also planning to open its first casino in 2024.

#2 Home prices are attractive

Japanese properties feel like a bargain to Chinese buyers who have been conditioned by years of high prices and small spaces in China's largest cities. Home prices in major Japanese cities have also tumbled significantly after the property bubble burst in 1990, making them very affordable to wealthy Chinese.

For instance, in Shanghai or Beijing, USD1 million could only buy approximately 53 square metres of prime residential space while in Tokyo, USD1 million could fetch at least 40 per cent more space, or about 76 square meters, according to estate agency Knight Frank.

This is a huge draw for Chinese buyers as average home prices in Beijing, Shanghai and Shenzhen have increased to as much as 46 times their average annual disposable income by end 2017.2 This has even prompted some Chinese investors to relinquish their earlier investments in other countries and use the money to buy in Japan instead. Others have decided that a Japanese apartment which is closer to home is easier to manage than a home, say in the United States or in Canada.

Furthermore, Japan also offers possibly the easiest entry points for foreign buyers across international borders. Chinese off-shore buyers can buy free-hold properties as opposed to land back home which is under government leases.

#3 Attractive returns

Japanese property yields are pull factors for Chinese buyers. Apartment rental yields in China are only about 2.6 per cent. By contrast, yields in Japan can reach nearly five per cent, according to Juwai.com.

Tokyo home prices rose by an average of seven to 10 per cent last year while in Osaka they jumped 12 per cent, reported Japan’s Ministry of Land, Infrastructure and Transport. Prices could climb another 10 to 20 per cent next year, according to property analysts.3

There is no official data in Japan tracking residential investment by private individuals whether they be foreigners or Japanese citizens but ordinary residential properties in Tokyo and Osaka seem to be in high demand amongst Chinese buyers.

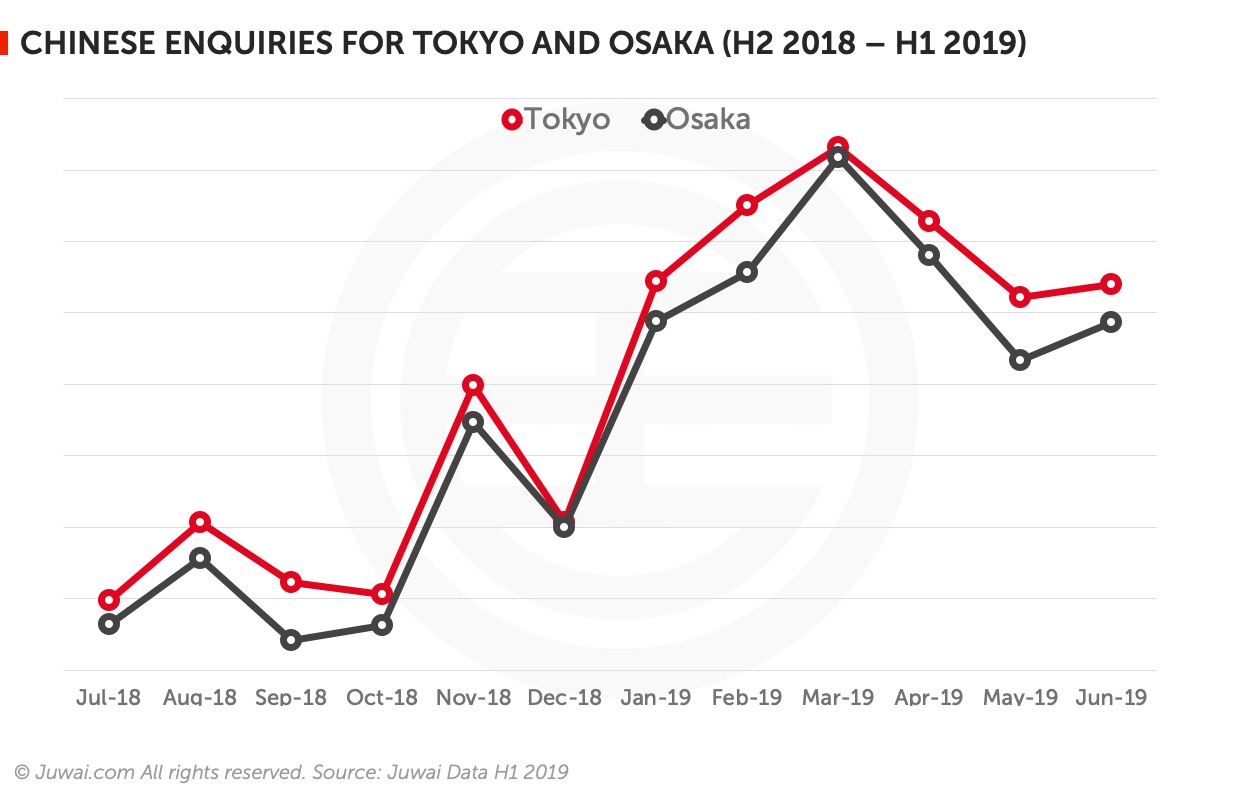

Juwai.com’s data shows enquiries by Chinese buyers for Tokyo properties had risen by an astounding 253 percent between the second half of 2018 and first half of this year. Last year, enquiries saw 57.4 per cent of Chinese looking for homes in the USD50,000 to USD250,000 price range while 33.5 per cent were interested in properties costing USD250,000 to USD500,000. Most cite investment as a prime reason followed by those who are looking to buy for self use. While enquiries may not translate to actual sales, they serve as a useful indicator for eventual demand.

Meanwhile, Osaka has seen between 15 per cent and 60 per cent increase in transactions made by Chinese buyers between January and March this year compared to the same period a year ago, according to local real estate agents.4

#4 Visa waiver

While obtaining residency in Japan can be challenging, Tokyo has made visiting the country easier. In 2017, the Japanese government introduced a multiple-entry visa programme for Chinese citizens. These visas are valid for five years and allow holders to stay in the country up to 90 days at a time, but not more than 180 days a year.

Furthermore, under the new rules, multi-entry visas for short-term business-purpose stays will be good for up to 10 years, rather than five years as in the past.5

Less restricted entry to nearby Japan is a great incentive for Chinese buyers as it allows them to commute easily from the mainland to either check on newly-purchased homes or to visit their children studying there.

#5 Higher education

Japan’s plan to accept 300,000 foreign students as part of a global strategy to open up the country to the rest of the world by 2020 has seen an influx of Chinese students. Currently there are some 298,980 overseas students studying in Japan, according to an education ministry report released in January this year. Of the total, students from Asian countries accounted for 95 per cent and students from China for 38.5 per cent.6

As more and more Chinese students choose to study in Japan, Chinese parents are looking for a second-home or an apartment to accommodate their children studying there.

#6 Top 10 liveable cities

Tokyo ranks seventh in the top ten most liveable cities in the world by EIU’s annual ranking report because it is considered to be a convenient, comfortable and an exciting city to live in. The impending Olympic Games and mass redevelopment around some of Tokyo’s major stations (Shibuya in particular) are expected to further bump up the city's ranking in the near future.

Osaka also featured in the top 10, placing fourth, thanks to the city’s comprehensive infrastructure, low crime rates and stable public transport.7

Chinese highly admire Japan’s high quality of life, culture and education, and politeness of its populace and these are great motivators for wanting to live there or for investing in a home in the country.