You've successfully copied this link.

The novel coronavirus outbreak and Chinese cross-border real estate buying

Like most fields of commerce, Chinese cross-border buying of real estate has felt the direct effects of the novel coronavirus epidemic. The outbreak is a real human tragedy for citizens of many countries around the world.

Here we assess the epidemic's impact on Chinese cross-border buying of residential real estate. Some of those impacts are not what one might expect. The situation is evolving rapidly. This is Juwai IQI's assessment of where things stand now.

Chinese Consumers at Home

To understand the impact of the epidemic on Chinese cross-border real estate buying in overseas markets, it helps to first understand the situation for these buyers at home, in China.

In much of the country, people are working at home or taking an enforced holiday until they can return to their workplaces. Many workers who went away on holiday have elected to stay away longer.

Shanghai's government has reported one-fifth of the city's technology and information workers are not yet back on the job. Of those who have restarted, almost two out of three or — 70 per cent — are working from home. The total is probably similar in Beijing and Tier 1 cities from which many Chinese cross-border buyers hail.

Negative Impacts

Mainland Chinese cannot currently travel to many countries. Out of fear of exposure, citizens of China and other countries have begun limiting their travel and public activities.

In several real estate markets, we already see negative impacts. These include a reduction in the in-person presence of Chinese buyers at auctions, a similar decrease at inspections, and the stalling between contract signing and final settlement of some transactions involving Chinese buyers.

Growth in Online Activity

Whether working at home or only staying at home, Chinese consumers are spending more time online. Reuters reports that some online activity has surged by 77%. 1 Companies like Tesla and Mercedes-Benz are spending heavily on online advertising while they have a captive audience.

"My screen time yesterday exceeded 10 hours," one Shanghai resident told Reuters. "What do you all suggest I do other than look at my cellphone?"

Later stages of property buying can be made more difficult by the inability of Chinese buyers to be physically present in overseas market. On the other hand, the earlier stages of the buying process —which mostly take place online and via phone and social media— are not obstructed at all.

The world is still uncertain when humanity will bring the coronavirus under control. When it does and the outbreak ends, the buyers who have begun their property purchasing process during this period will be well advanced in their research and possibly in their negotiations. The pent-up activity may result in an unusually large number of transactions over one or two quarters, as buyers complete delayed transactions.

Where Demand Is Growing

The chart shows selected countries where Chinese buyer enquiries increased in January, despite the coronavirus outbreak. Except for Germany, these countries are all located in Asia-Pacific.

VIETNAM

Vietnam has been the biggest beneficiary of displaced investment due to the trade war. Despite some distrust, commercial ties with China have been multiplying.

The Vietnamese economy grew by a vigorous 7.1 per cent in 2018. The real estate market attracts investment because of this strong economic growth, rapid urbanization and the development of

several mega projects in major cities. Vietnamese real estate has attracted a record amount of international investment in the last few years.

NEW ZEALAND

Chinese buyers bought USD$952 million of real estate in New Zealand in 2018. Since the government passed more stringent restrictions on foreign investment, the non-citizen buyers' share of all residential purchases in central Auckland dropped from 34 per cent to 17.3 per cent, according to official data. In New Zealand as a whole, their share fell from about 10 per cent to about 8 per cent.

New Zealand is appealing to many Chinese buyers who appreciate its slower pace, smaller size, and healthier lifestyle and environment. More than two-thirds of Chinese buyers in New Zealand are purchasing for their own use while studying or otherwise living in the country.

SINGAPORE

In 2019, Chinese buyers made 55.3% more buying inquiries on Singapore residential real estate than in 2018. The most significant surge in demand took place in the second and third quarters, while in the fourth quarter demand dropped back from the mid-year high.

The Chinese regions that account for the largest share of buyers enquiring on Singapore property are Guangdong (28 per cent), Beijing (14 per cent), Hebei (12 per cent), Hong Kong (12 per cent), Tianjin (9 per cent), and Singapore (8 per cent).

GERMANY

Chinese investment in German residential real estate is relatively low by global levels. Some Chinese buyers are simply investors. Other transactions are the positive side effects of Chinese commercial investment in Germany, which companies and individuals purchasing property for their own use.

The three top German cities for Chinese buying enquiries are Berlin, Düsseldorf, and Munich. Berlin, however, predominates by far. It receives more than triple the enquiries as do the other cities.

AUSTRALIA

Despite the damage to its brand caused by the recent bushfires, Australia is still perceived as a safe, close, clean and inviting destination for Chinese tourists, students, investors and ex-pats.

After several years of decline, Chinese demand began to recover in 2019, with buying enquiries on Australian real estate up 42% from 2018. The Coronavirus apart, we expect to see further improvement in Chinese buyer demand in 2020.

Looking Forward

Were the epidemic to be contained within February or at the latest within the first quarter of 2020, the impact on Chinese cross-border buyer transactions, investment levels, and market share should be relatively small and limited to a short period. However, we expect the impacts to vary across national and metro markets.

We do not believe the virus will deter future Chinese cross-border home buying and investment. We do not believe it undermines the motivations of investment diversification, lifestyle goals, healthcare and overseas education. We do not believe the virus will contribute to any reduction in Chinese demand for overseas residential real estate.

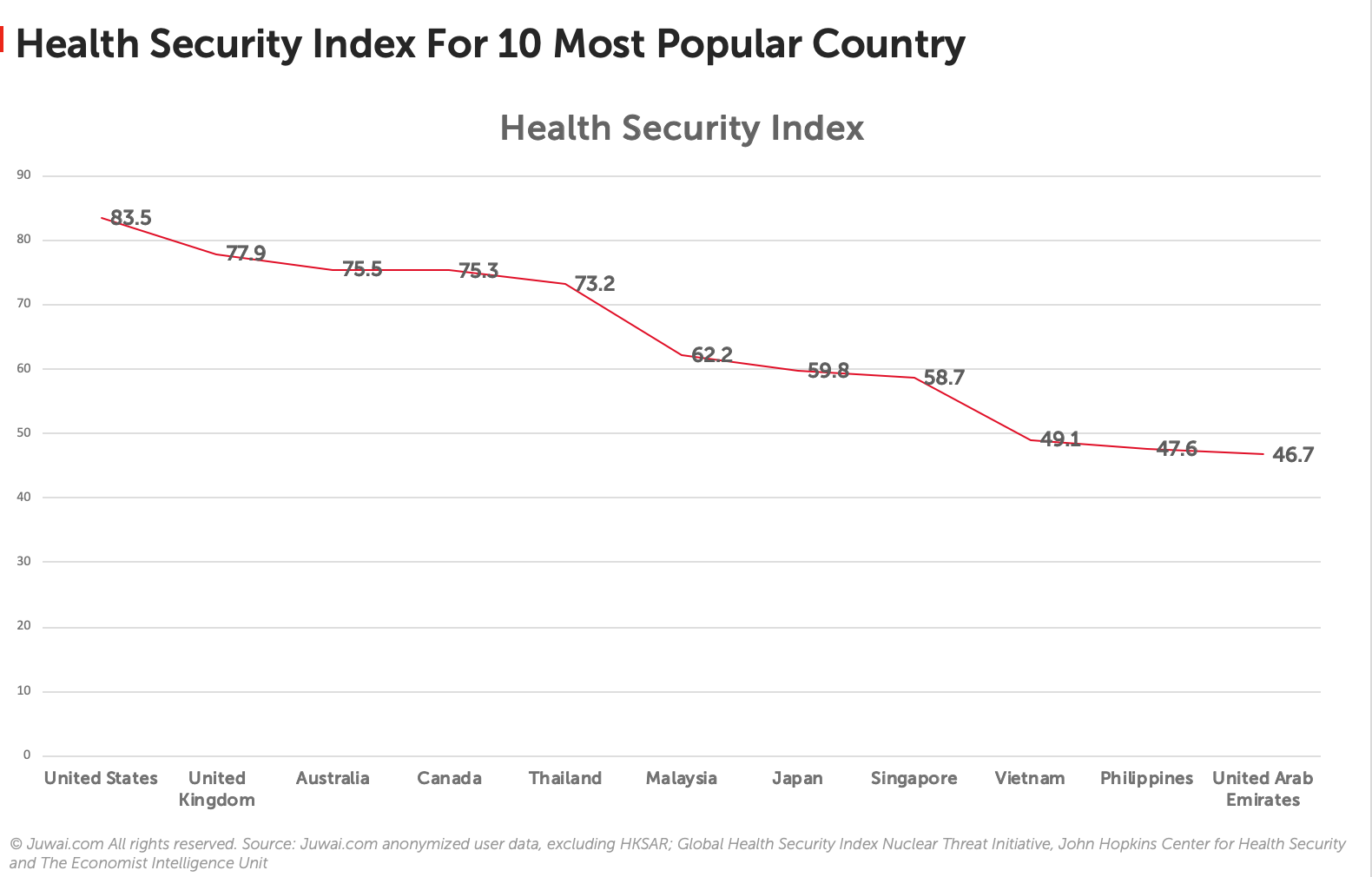

HEALTH SECURITY

As a result of the Covid-19 outbreak, investors, especially those who buy overseas properties as holiday homes or pensions, may also take local public health infrastructure and medical resources into account. Already, Juwai.com consumer surveys show that healthcare is one of the five most important motivators for overseas property buyers. It is especially important for retiree buyers.

The table shows how the top 20 countries for Chinese buyers rank on health security, defined as the capacity to prevent, detect and rapidly respond to public health emergencies such as a viral outbreak. The data on health security comes from a report authored by the Nuclear Threat Initiative, Johns Hopkins Center for Health Security and The Economist Intelligence Unit.

Among China’s nearest neighbours, only Thailand —at No. 6— ranks in the top 10 for health security. Thailand has even integrated its tourism and medical resources organically to make it a "medical tourism" destination for the world's patients.

Other countries that are in the top 10 for health security and are also among the 20 most popular for Chinese buyers include Australia, the United States, Canada, and the United Kingdom.

Source: Reuters: Millions in China banish virus blues with online games, video apps