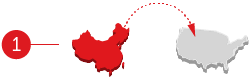

Where are Chinese looking globally?

International real estate investment by Chinese consumers is evolving rapidly as these buyers gain in wealth, motivation and sophistication.

Where are Chinese buyers looking to invest, though? We shed light on the top 10 countries most enquired by Chinese property investors on Juwai.com in the adjacent map.

Interestingly, each Chinese buyer is diferent, and while many share similar yet somewhat distinct aspects, where they hail from influences their motivations and dictates their buying preferences as well.

3 Chinese buyers segments

Juwai connects with all 3 segments

Mainland Chinese buyers

- Living in mainland China

- Looking at properties oversea

Example: Chinese buyer in Qingdao city looking at property in Australia

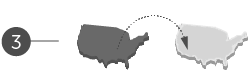

International Chinese buyers

- Living outside mainland China

- Looking at international properties located outside the country they’re living in

Example: Chinese buyer in the US looking at property in Australia

Domestic Chinese buyers

- Living outside mainland China

- Looking at domestic properties located in the country they’re living in

Example: Chinese buyer in Australia looking at property in Australia

Ask about Juwai Insights data services

Juwai Insights data is based on the online activity of more than 10.2 million monthly active users – from 326 cities in China and 196 countries around the world – searching and enquiring about properties on Juwai.com.

This is the first and most comprehensive set of data on the global Chinese property buying audience to ever be tracked, providing unparalleled insight into the preferences and purchasing intent of Chinese property buyers around the world.

Juwai Insights data has been featured and cited by major press and financial organisations, including Credit Suisse, CNN, New York Times, The Wall Street Journal, Bloomberg and CNBC.

*Juwai Insights data is currently reserved for media, government organisations, and other third-party advertisers

Top Stories

Juwai Chinese Buyer Market Insights 2025: Where Asians and Chinese Are Looking For

Why are Chinese buyers pivoting to Asia-Pacific real estate? From January to September 2025, the cross-border property interests of Chinese and Asian buyers experienced a significant geopolitical shift. Analysis of Juwai.com and...

Continue reading >Global Sentiment Shifts: China’s Image Improves as U.S. Popularity Declines

Global perceptions are shifting. According to the latest Pew Research Center survey, more countries are viewing China in a positive light for the first time since the pandemic, while the U.S. faces...

Continue reading >Chinese Investment in Malaysia Surges to RM31 Billion, Led by Mega Steel and Energy Projects

Chinese investors poured RM31 billion into Malaysia in 2024 more than double the previous year marking the second-largest inflow of Chinese capital on record, according to new data from Juwai IQI. Major...

Continue reading >Dubai’s Record 2025 Growth Puts It on Track to Meet D33 Vision Goals

Dubai’s booming trade, tourism, and aviation performance in 2025 positions the emirate firmly on track to achieve its Dubai Economic Agenda (D33) targets, says Kashif Ansari, Co-Founder and Group CEO of Juwai...

Continue reading >2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service