How to sell property to Asian and Chinese buyers

Asian and Chinese buyers are the most prominent international property buyers globally, viewing real estate as valuable. For them, a property serves as their home and a haven for their future, a safeguard for retirement, a legacy for their children and collateral to grow their wealth.

But who are they? In many cases, these buyers want to provide their children with a place to stay while studying overseas. Furthermore, the remaining factors for motivation could be retirement, purchasing a holiday home or emigration.

3 types of Asian buyers

Asians living abroad who would like to buy a property where they are stationed.

Asians who are still staying in their homeland but would like to buy a property overseas.

Asians buying domestically in their homeland.

Depending on where they're from, different selling rules apply. Asians who don't reside in the destinations where they would like to buy property are different from those who are already residents. In some countries, non-residents can only buy new developments such as apartments and condominiums and not landed properties because the law from these countries doesn't allow non-resident foreigners to invest in second-hand homes or in landed properties or they might need to seek approval from relevant authorities.

Why is the Chinese such a

formidable market for real estate?

China boasts some of the wealthiest people on the planet, most whose personal fortunes can dwarf treasuries of medium-sized countries, and the growing population of high-net-worth Chinese now also has their eyes set on international property. According to IMR forecasts and Bloomberg calculations, China will be the world’s biggest growth engine in the years ahead and Chinese buyers are expected to be the leading group in global property acquisition.

In the past few years, Chinese buyers have started to make their presence

felt on the global property market, snapping up everything from luxurious

trophy homes and vineyards, to more modest condominiums and investment

opportunities. For many Chinese, global property investment is an emerging

opportunity which until recently was out of reach.

Second only to the US in terms of international buying power, Chinese buyers

represent a tremendous new market opportunity for property sellers around

the world. Yet, new opportunity brings new

challenges in reaching, communicating and engaging this new market.

Great rise of the Chinese consumer

China boasts some of the wealthiest people on the planet, most whose personal fortunes can dwarf treasuries of medium-sized countries, and the growing population of high net worth Chinese now also has their eyes set on international property.

720 million

Middle-class Chinese by 2024

6 million

HNW Chinese by 2025

57 million

Affluent Chinese by 2022

Motivations for Chinese global property investment

Education

of Mainland Chinese

intend to educate their children overseas

Investment

of affluent Chinese

buy international real estate for investment diversification

OWN USE

of rich Chinese

buy real estate abroad to live in 37%

purchase overseas property as their primary residence

Emigration

of China’s HNWIs

have either migrated or are planning to move overseas

Holiday

of China’s HNWIs

go overseas 4 times per year on average

Rental

of wealthy Chinese

invest in international property for rental income

In the US, this number climbs up to 28%

Retirement

of HNW Chinese

purchase overseas property for retirement

How Asians and Chinese search for property

The internet has become a vital link between sellers and buyers. Most buyers nowadays will do their research online before communicating with sellers and rely on online listings to get their first look at a property.

This means that sellers will have to up their game and embrace technology to reach out to modern-day buyers.

China ranks first in countries with the most internet users due to its ongoing and fast-paced economic development as well as a cultural inclination towards technology. More than 904 million of the estimated 1.38 billion population in China are online. Some of the other notable emerging markets are India, with a projected number of internet users of 636 million by 2021, or Indonesia, which is expected to have 144.2 million of its citizens surfing the World Wide Web around the same year.

Like many others, Asians are avid internet users and have embraced it for almost every aspect of their lives - including searching for real estate opportunities outside of homeland borders.

of Mainland Chinese

speaks fluent English

of China's HNWIs

are active WeChat users

of affluent Chinese

access the internet each day

91 million

online property seekers

897 million

mobile internet users

904 million

Chinese online users

How to sell property to Asian and Chinese buyers

One of the largest groups of international property buyers, Chinese property buyers, are seeking destinations offering an attractive lifestyle, educational opportunities and immigrant investment.

Compared to domestic purchases, buying property overseas is often a prolonged process. Several factors include language barrier, regulations and taxes from certain countries regarding foreign buyers, and lack of information.

It is essential to have a comprehensive understanding of their buying habits, and it is necessary to adopt a long-term plan to cater to these Chinese buyers. So how do agents or developers reach these Chinese investors and learn about their needs?

Juwai.com & Juwai.asia

With 10.2 million monthly active users, Juwai (through Juwai.com and Juwai.asia) is one of the largest international property platforms in Asia. We aim to bridge the gap between Chinese investors and our listings, for easier purchase of a better lifestyle - no matter where they are. On a global scale, our portals are ready to provide an answer to their investment inquiries.

On Juwai.com and Juwai.asia, the listings are presented in Chinese and English with your branding and your contact information. They can be found in the search section on the two websites.

+ Go to Juwai.com + Go to Juwai.asia

Juwai Live Program

More recently, technology has also altered the way real estate is being sold. Online and virtual events and presentations have replaced face-to-face appointments and mass gatherings in expos and tradeshows. The most striking phenomenon is how buyers have accepted this change, in part caused by the COVID-19 pandemic which has curbed travelling.

Juwai has been actively hosting virtual promotional events, conferences and webinars to connect sellers and other real estate professionals with buyers through livestreaming on its “Juwai Live Program” on Facebook which has seen increased audience participation. This is another innovative way for you to reach prospective Asian customers.

+ Learn more Juwai Live Program

Juwai Admin

We also offer tools for agents to bridge online to offline, such as QR codes that Chinese can scan to view listings right on their phone. Or brochure downloads that you can print out and hand out to the buyers visiting you in person. If you want to manage your Chinese language listing content, just log in to Juwai Admin. Our English-language admin system is designed for agents to let them manage their Chinese language account.

+ Sign up now

Chinese consumer support centre

And if you don't speak Chinese, we've got you covered. Our Chinese consumer support centre offers Chinese buyer support to answer questions from Chinese buyers for all of your listings on the site. So when a buyer enquires about your property, that information is translated and sent directly to you. So don't let another vendor presentation fall short. Show property sellers how you're marketing to Chinese buyers with Juwai.com.

+ List your properties with usThere are 3 types of Chinese buyers

Firstly, it is important to note that there are different types of Chinese buyers with different needs:

International Chinese Buyers

Chinese citizens who are currently living overseas and looking for a property in another country.

(for example, Chinese citizens living in the US but looking for a property in Australia).

Domestic Chinese Buyers

Domestic Chinese buyers living outside of China who are looking for property in their current country of residence.

Mainland Chinese Buyers

Mainland Chinese buyers who are currently located in Mainland China but are looking to purchase property overseas.

These three types of buyers have different requirements and needs. Agents and developers should do well to take note and differentiate them. After you have identified which category your prospective Chinese customer falls under, here are a few tips on how to better sell to them.

Leverage digital and mobile tools

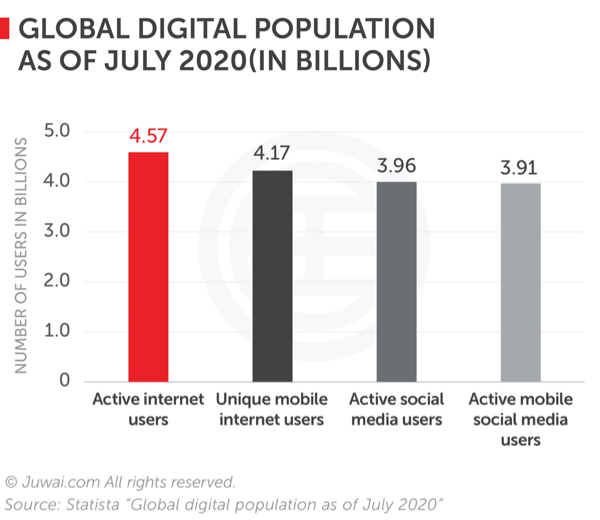

Without a doubt, the world has become very digital-centric. Across the globe, the internet continues to transform how we connect with others, organise the flow of things, and share information. With its growing influence on individual consumers and large economies alike, the internet has become an increasingly vital part of our day-to-day lives. As of July 2020, internet users worldwide stood at 4.57 billion, encompassing 59% of the global population. And the digital population is still growing in many parts of the world.Nowadays, social media has become an indispensable tool for information, communication and entertainment.

Feng Shui

Most Chinese believe in feng shui when it comes to buying property. Feng shui is a practice anchored in traditional Chinese culture of looking at our living spaces and working environment and striking a balance with the natural world. It looks at the positioning of the house, orientation, layout, street numbers, etc. For example, if a house has a hill or mountain at its back, it represents protection. An uninterrupted hallway leading to the front door means positive energy can gather and flow through to nourish the home and family.Whilst many feng shui factors can be changed, feng shui dos and don'ts have been known to make or break a sale. Don't hesitate to point out positive feng shui elements in your marketing collateral and make sure you don't promote the negative ones.

Numerology

The Chinese also believe in numerology and are huge fans of numbers. Numbers play a significant role in their decision making when purchasing a home. The numbers 3, 6, 8 and 9 are considered lucky in Chinese culture whilst the number 4 is considered terribly unlucky because the pronunciation of the word 'four' in Mandarin sounds way too close for comfort to the word for 'death'.In real estate, the more lucky numbers appear in a house address, floor level or price, the better it is. Many agents and developers have been able to make a quick sale simply because they are savvy enough to change the house's street address number - for instance, from 64 to 68.

Longevity

The relative security of a long-term or freehold lease is something many Chinese are willing to invest in. When buying property overseas, Chinese are looking for a safe place to call home for years to come.They covet a place of their own where they can raise their family and invest for future generations. Destinations that offer residency are always a huge draw.

Education

Children education ranks high in most Chinese families as they believe it will lead to a prosperous future for their family. That's why Chinese prefer properties located near well-respected high schools or universities.Properties close to established educational centres, should be promoted prominently in your pitch to Chinese foreign buyers.

Return on Investment

Chinese buying for investment want to be sure they can rent out the properties they purchase if they are not living in them. Agents and developers should make sure they know about the rental yield on the property or provide a positive outlook where housing prices are set to increase in the future to maximize the appeal of a propert. Like everybody else, Chinese investors want a favorable investment return before they commit to buying a property.Those who invest in a second or holiday home will most likely visit it whenever possible with ease. Highlighting transport links such as direct flights or the proximity to international airports when promoting your listings will assure buyers that they can travel easily to and from their new home.

Prestige

Status and the notion of “face” are important in Chinese culture. Appearing successful and wealthy to their peers enhances their reputation; thus, buying an overseas property in a well-known or prestigious location rachets up their social rankings.When formulating your pitch, be sure to reference the local landmarks, history or past celebrity owners and other success stories that could lend weight as to why the property is worth buying.

Visas

Chinese are the largest group of customers for schemes selling foreign residency. Getting a passport or long-term residents' visa in a foreign country would make it easier for them to live, work and educate their children in their new home.The right to reside in a foreign country is one of the key factors a Chinese buyer considers when looking for property overseas. Hence if you could offer additional services or have partners that specialize in the immigration sector working with you, you are more likely to draw Chinese buyers.

Lifestyle

Another prime motivation for Chinese living abroad is a better-quality lifestyle than they currently have in their own country. This presents significant opportunities for the realtors as it allows you to sell “bonus features” of a property such as a garden, pool, storage, indoor garage and gym, or open plan living spaces which would be much more expensive in their respective country.Besides physical attributes of the property, positive environmental aspects - clean air, an abundance of nature, verdant landscape - are added plus points that could win over a Chinese buyer.

Retirement

China is not only the country with the largest population on earth, it is also the country with the fastest ageing population. This is mainly due to decades of falling birth rates on the one hand and steeply rising life expectancy on the other. As such, retirement is one of the major motivating factors for Chinese buyers who decide to purchase property overseas.Many well-to-do Chinese are getting creative in stretching their money for a comfortable - and even luxurious – retirement place to live. Chinese looking overseas for retirement seek destinations where there is decent healthcare, have a safe community, a pristine environment and good weather. It also has to be a good investment - both for them and for their children in the future.

If you are a residential developer targeting this segment of Chinese buyers, you can win them over by pointing out the advantages your development can offer to senior citizens and start specifically catering to this community by showing how easy it is for them to adapt to local life in their golden years.

Top Stories

Chinese pay attention to numbers when considering home purchases

Knowing the implicit meanings behind numbers will serve as an important tool in accessing Chinese culture and help you understand your Chinese customers better. Beliefs in lucky and unlucky numbers are often...

Continue reading >

How Chinese enclaves became cultural hubs in Australia

From a haven for new migrants to an attraction for tourists, Chinatowns are now a cosmopolitan bridge between Australia and Asia Chinatowns exist in most Australian states and territories, especially in...

Continue reading >

How to sell property to Chinese buyers

Chinese buyers are now the fastest growing segment of real estate buyers globally as they seek out destinations that offer an attractive way of life, immigrant investment and educational opportunities. However, cross-border...

Continue reading >

10 things you need to know about gift-giving in China

Whether you want to give a present to a Chinese customer for the holidays, or just to build a relationship, bear in mind that there are some things to never gift a...

Continue reading >

6 Signs You're Prepared to Invest in Foreign Property

The title of ‘expatriate' has a distinctive prestigious meaning behind it. Moreover, living and working abroad can be a very rewarding experience, professionally, personally, culturally, and of course, financially. If you have...

Continue reading >

How colours can make your house more attractive to Chinese buyers

China is a country rich with heritage and uses colours symbolically within every ceremony, festival, and ritual. Even at home, Chinese believe the use of colours that follow principles of feng shui can create...

Continue reading >2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service