You've successfully copied this link.

Juwai reveals Q2 2016 Global Property Index (GPI) Report

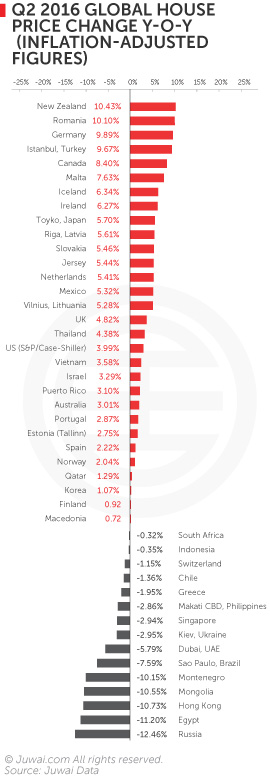

Housing prices were up in 30 – out of the 45 – housing markets that have published housing statistics so far.

We break down our latest GPI report, based on inflation-adjusted figures, and take a look at where the strongest and weakest housing markets are for the second quarter of the year.

The Juwai GPI Report is specifically tailored to equip Chinese buyers with research for overseas property investment abroad.

Global housing markets remain polarised – while housing markets in Europe, most of North America, and New Zealand are cresting on a strong rally, those in the Middle East and the majority of Asia have slowed dramatically.

Over in North America, the US and Canadian markets stay robust and buoyant, as both momentum and real estate demands remain unaffected by the slow economic recovery in the US, nor by the property cooling measures imposed in Canada.

Europe, home to seven out of the ten strongest housing markets, remains dominant – 17 out of its 22 European housing markets charted price increases in Q2 2016.

Nevertheless, New Zealand has overtaken Europe to take the lead as the strongest performer this quarter with a 10.43% increase. In contrast, the Australian market underwent a gradual slowdown.

Here in Asia, we see a sharp polarisation. Nine Asian markets were upbeat and either charted housing price gains or performed better than the previous quarter, while the remaining Asian markets continued their declining streak.

Elsewhere, most housing markets in the Middle East are cooling down and losing momentum, paling in comparison to the record highs charted a year ago.

Regional snapshots

North American markets remain buoyant

-

US real estate market still strong amidst slow economic recovery – bolstered by sharp upsurge in housing demand, the S&P/Case-Shiller seasonally adjusted national home pricing grew 3.99%, a 1.89% increase y-o-y.

-

Canadian market stays robust despite repeated cooling measures and market regulations – housing prices in 11 major cities still grew 4.41% q-o-q and 8.40% y-o-y from the 4.0% charted in Q2 2015, the biggest annual increase since Q2 2010.

Pacific Ocean/Oceania markets head opposite directions

-

New Zealand housing market accelerates – nationwide median housing prices surged as much as 10.43%, a 5.19% y-o-y increase from the year before.

-

Australian market downtrend continues – housing prices in its eight major cities rose and then slowed down, charting a property price growth of merely 3.0% y-o-y, its lowest increase in nearly three years since Q3 2013.

Most European markets heat up

-

Romanian market charts surprising growth of 10.10% – this is thanks to its relatively robust economic growth of 3.7%, which ranks as one of the highest economic growth rate within the EU, and is a stark contrast from its sluggish economy between 2009 and 2014.

-

Germany’s housing market leapt 9.89% – a combination of strong economic fundamentals, ultra-low interest rate policy, and housing supply shortages were driving factors that saw housing prices in Germany remaining strong.

-

Turkey housing market rally continues – strong foreign investment and population growth has led to a 9.67% increase, defying Turkey’s sharp currency devaluations, public dissatisfaction with the Turkish government, and geopolitical tensions.

-

Maltese real estate market on the rise – driven by government initiatives, including waiving stamp-duty fees for first-time homebuyers, property demand in Malta surged and saw its housing prices soar 7.63%.

-

Iceland housing price upsurge continues – a robust demand for property, coupled with limited housing supply (particularly in its capital city of Reykjavik), has fuelled a y-o-y growth of 6.34% this quarter.

-

Ireland market still charting gains, albeit at a slower pace – Irish housing prices grew 6.27%, thanks to its healthy economic growth rate, which is still ranked first in the EU. The Irish economy is projected to achieve a healthy growth of 5% this year, along with an additional 3.6% increase expected for 2017.

-

Other European countries showing strong performances – Latvia (+5.61%), Slovakia (+5.46%), the Netherlands (+5.41%), Lithuania (+5.28%), and the UK (+4.82%).

-

Other European countries showing slight growth – Portugal (+2.87%), Estonia (+2.75%), Spain (+2.22%), Norway (+2.04%), Finland (+0.92%), and Macedonia (+0.72%).

European markets still in decline

-

Russia remains the worst-performing housing market – beset by myriad problems, including its most severe economic crisis since 2009, the Russian government has adopted a prudent monetary policy and stabilised overall inflation rates. However, Russian housing prices continued its decline to fall -12.46% y-o-y in Q2 2016.

-

Montenegro property market deceleration continues – despite an economic growth rate that is expected to be 4.7% healthier this year, housing prices still dropped -10.15% y-o-y.

-

Other European countries with slight declines – Ukraine (-2.95%), Greece (-1.95%), and Switzerland (-1.15%).

Asian markets continue to polarise

-

Japan housing market continues its ascent – despite being in the doldrums with an economy downturn, housing prices rose 5.70% y-o-y thanks to growing housing demand, government stimulus, and the appreciation of the Japanese Yen that increased the value of Japanese property as assets.

-

Other Asian countries showing modest growth – Thailand (+4.38%), Vietnam (+3.58%), and South Korea (+1.07%).

-

Singapore private apartment market continues to bottom – Singapore’s economy grew 2.2% in Q2 2016, and while housing prices continued its twelfth consecutive quarterly decline to fall -2.94%, housing demand and supply has picked up.

-

Hong Kong market remains in decline – despite an economy growth of 1.7% in Q2, property prices still fell -10.73% y-o-y in Hong Kong, a sharp contrast from the 16.88% y-o-y rise the year before.

-

Mongolia market slump prevails – a severe economic recession and weak GDP growth of only 0.4% caused by high foreign debt and fiscal revenue decline has led housing prices to dive -10.55% y-o-y.

-

Philippine housing prices chart weaker growth – although housing prices of 3-bedroom apartments in the Makati CBD grew 2.89% on average in Q2 2016, its y-o-y figure still dropped -3.9% compared to the previous year. Philippines’s robust economic growth of 7% last year is expected to continue at a slightly slower rate of 6% for 2016 and 6.2% for 2017.

-

Indonesia market displays feeble performance – housing prices dipped -0.35% y-o-y, as housing demand continues to weaken substantially. Overall housing supply growth rate is projected to slowdown gradually in the coming years. Nevertheless, the government’s decision to fully liberalise restrictions on foreign buyers for luxury property in Indonesia, coupled with its expected economic growth rate of 4.9% may turn things around in future.

Middle East markets generally losing momentum

-

Israeli housing market flags – emulating its economic slowdown and weakening housing demand, property prices merely rose 3.9% this quarter, its lowest y-o-y growth since Q1 2014 and a far cry from the 7.66% y-o-y growth charted before.

-

Qatar property market slows down – weakened by an economic downtrend, Qatar housing prices only grew 1.29% y-o-y, a dramatic contrast from the 21.47% growth in Q2 2015. However, property demand remained strong in 1H 2016, thanks to its sustainable economic growth, population growth, and the construction boom due to the 2022 FIFA World Cup.

-

Dubai housing market stays volatile – property prices fell -5.79% y-o-y, even as investor sentiment weakens amidst a subdued economy brought on by lower oil prices, an economic slowdown, China’s economic deceleration, and expected regional government spending cuts.

-

Egypt market slumps – Egypt’s real estate index slipped -11.2%. However, with an improved economic decline of only 1.2% expected this year – its best level in seven years – and with the lifting of restrictions on foreign property and land ownership in Egypt, we may soon see the winds of change in Egypt.

Other housing markets of note

-

Mexican housing market remains strong – property prices grew 5.32% y-o-y, thanks to overseas buyer demands for Mexican tourism property, which has remained robust.

-

Brazilian market still sluggish – mired in its longest economic crisis since 2014, which has been worsened by prolonged political uncertainty and corruption scandals, property prices in Sao Paulo fell -7.59%.

-

Chilean property market declines – a new 19% property sales tax implemented in 2016 saw average housing prices of new apartments in the Greater Santiago dropping -1.36%.

Conclusion

Overall, the Q2 research shows that while cooling measures imposed by certain governments – such as Singapore – has been effective, some housing markets around the world are still defying property restrictions to continue heating up.

Nevertheless, with many other markets showing falling property prices, this is music to the ears for Chinese buyers who are now more adventurous and looking further afield for their real estate investments. So for agents and brokers who on top of global trends, this is an opportunity for you to woo Chinese buyers who are eyeing less traditional markets.

Download the full GPI Report in Chinese here.

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service