You've successfully copied this link.

How livestreaming is sustaining real estate industry by reaching out to stay-at-home Chinese and Asian buyers

The digital consumption habits of consumers, whether globally or in Asia, have seen tremendous changes in response to the Coronavirus pandemic.

It is clear that after travel bans, stay-at-home and social distancing measures were imposed, new media consumption behaviours have emerged, fuelled by disrupted daily routines. With millions of consumers confined to their homes since the virus outbreak, livestreaming has become an essential way for real estate marketers to engage with property investors especially high-net-worth individuals (HNWIs) in immediate and authentic ways in a live setting that other social media formats cannot as it allows feedback and questions from viewers who can then receive answers instantaneously, almost in the same way as a face-to-face encounter.

No longer a novelty, real estate marketers who want to sustain and continue to build their brand during these challenging times will need to re-examine new ways to win and engage with Chinese and Asian buyers. Livestreaming, as such, appears to have found its moment.

Livestreaming in China

China’s experience of livestreaming points to a way for brands to both continue to promote and sell their products and has evolved from its role as an initial entertainment channel to one that has become essential for brands during the COVID-19 crisis to reach out to consumers. This trend is likely to continue even after the country returns to normality, experts say.

Livestreaming was already very much in trend in mainland China – which has a total of 904 million netizens - even before the COVID-19 pandemic struck. Now lockdowns have further accelerated that process, according to the China Internet Report from South China Morning Post1. The growth of livestreaming in China is now entering a third phase, with a range of traditional sectors adopting it as an effective marketing channel.

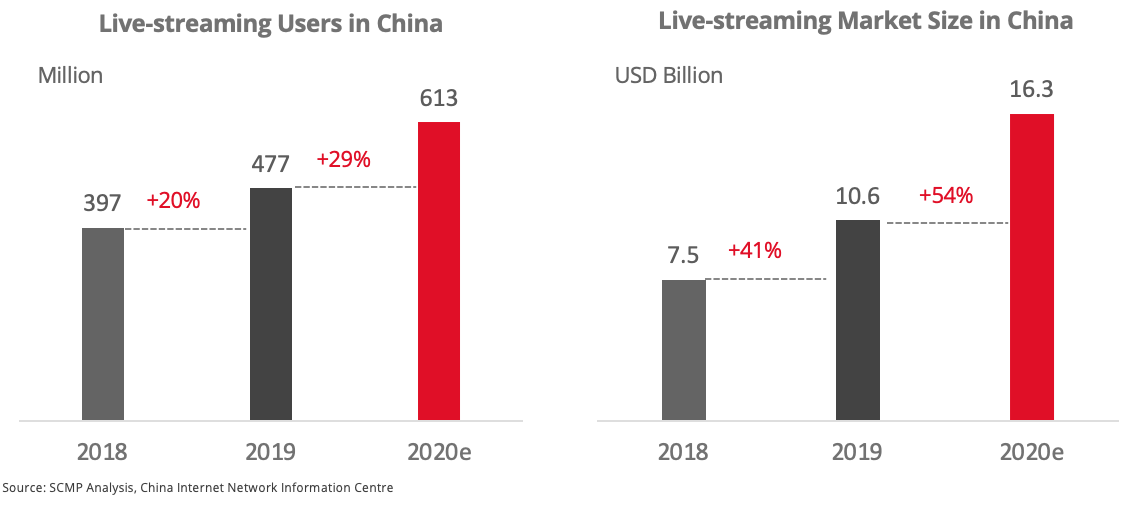

The report reveals that by 2020, there will be 613 million livestreaming users, a 29% increase on 2019 (compared to 20% growth in 2018-19).

From its first phase as a niche market populated largely by gamers and teens, livestreaming has evolved in the past couple of years to emerge as a shopping and e-commerce channel, particularly for FMCG goods; in this third phase, industries as varied as real estate, automotive, travel services and luxury goods are finding ways to use livestreaming to their advantage.

The real estate industry has benefitted from this trend. For instance, Taobao livestreaming of real estate topics has attracted over 5,000 estate agents from over 500 brokers, across nearly 100 cities in China. During February 22 – 17, some two million users watched real estate events streamed live on Taobao Live.

Similarly, in Shanghai, Juwai IQI has been actively hosting virtual promotional events and conferences for professionals in the real estate industry. A recent summit on overseas homes organised by Juwai IQI Group and Baidu Shanghai attracted nearly 400,000 viewers on four major platforms (Baidu Live Room, Haokan Video Live Room, Little Goose Tong Live Room and Lu profes).

Livestreaming outside of China

With the popularity of video marketing on the rise, livestreaming has become one of the most effective ways to circumvent the chaos created by the pandemic which has curbed travel and face-to-face meetings between property sellers and buyers.

With the popularity of video marketing on the rise, livestreaming has become one of the most effective ways to circumvent the chaos created by the pandemic which has curbed travel and face-to-face meetings between property sellers and buyers.

Online conference platforms allow everyone including HNWIs to experience the same benefits of onsite events such as the connection you made bumping into someone in a breakout session, the potential customer you met at your booth or a useful tip coming from a panel speaker.

Livestreaming was still nascent on Facebook about five years ago. Fast forward to present day, there are nearly 2.6 billion people using Facebook alone, and more than 2.3 billion people2 using at least one of their services every day. Without doubt, according to data from Newswhip, a tracker of social trends and activity, livestreams are already getting huge engagement on Facebook.

This makes Facebook a fantastic advertising platform for real estate marketers to consider in their overall advertising mix. On live broadcasts, viewers are encouraged to interact with the host and ask questions. Engagement is one of the most amazing opportunities for realtors to explain to prospective property investors why their projects are attractive and appealing.

Businesses that have utilised Facebook’s livestreaming feature with great success include Starbucks, Sephora, Bloomberg, etc. Juwai IQI is also an early adopter of Facebook livestreaming and has hosted several “Juwai Live” seminars from Hong Kong to introduce foreign agents and their offerings to Chinese cross-property buyers and the strategy has worked. Juwai IQI’s live programme is now seeing increasing audience participation and recent live sessions to promote property developments outside of China have garnered close to 180,000 viewers.

According to Juwai, fully online events and webinars have shown better results, achieve much better outcomes for all parties at a better ROI than offline property expos and get better reach. Juwai says it has seen audiences for its online live events soared in size.

The Future

As coronavirus restrictions ease, wealthy Chinese investors are making a move in overseas property hotspots again. In Singapore, virtual tours and photos have been enough to seal multi-million-dollar deals, pointing to how transactions are evolving.

This illustrates that participation in an interactive virtual experience will be fundamental to the long-term success of businesses in or related to the real estate industry as it replaces in-person conferences, face-to-face meetings and other onsite events. And as more and more people familiarise themselves with interactive livestreaming, its benefits will become increasingly apparent especially when it comes to wooing Chinese and Asian property investors.

Sources: 1. SCMP: The China Internet Report 2020; 2. Facebook Vitals - Q1 2020 IR Statement

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service