Asia News

- Home

- News

- Asia News

You've successfully copied this link.

China's Golden Week will rock global property markets

Real estate agents, brokers and developers are taking a leaf out of the international retailers’ playbook when it comes to wooing Chinese buyers.

The phenomenon where 6.15 million Chinese traveled abroad during National Day Golden Week 2017 will hit again from 1 to 7 October 2018.1

Mainland Chinese try to make the most of the two extended holidays a year, which falls at the beginning of the year and the other for China’s National Day in October by travelling within the country and abroad.2 The number is expected to grow in the long term as experts predict that the number of Chinese passport holders will double up to 240 million by the year 2020.3 Moreover, this number only represents 17% of China’s total population and is projected to keep increasing in the coming years.

Spending

This presents ample commercial opportunities as Chinese tourists are ranked first in spending money overseas by United Nations World Tourism Organisation. They splurged US$115 billion in various expenditure in 2017.4 Goldman Sachs estimated in 2015 that the figure will surge to US$450 billion by 2025.5

According to Juwai’s 2018 Chinese International Travel Survey, 77% of Chinese have property purchase intentions in mind when they travel overseas and 49% will or may schedule appointments to meet international real estate agents during their journey.

It is not surprising that real estate professionals seize upon this short window of opportunity to connect with as many foreign visitors as they can. 2016 saw Chinese real estate investors spending a record US$101.4 billion on both residential and commercial properties globally – up 845% over the past five years, and a 25.4% growth from 2015.

To cater to the needs of this demanding clientele, companies have thought of unique ways to service them. Now, private tours in Rolls Royces and chartered coaches bring potential customers around top property areas barely raise an eyebrow as agents and brokers pull out all stops to pander to the Chinese penchant for real estate investments.

Chinese buyers generally see foreign property as better value compared to the exorbitant costs at home. An Australian Financial Review article6 noted, ‘while AU$1.74 million (US$1.27 million) buys you a nondescript apartment in suburban Shanghai, in Sydney for not much more money you can be downtown with water views’, citing two bedroom off-the-plan apartments of 84 square meters going for AU$1.85 million (US$1.35 million) in March 2017.

Popular destinations

The China Outbound Tourism Research Institute (COTRI) predicts that overseas trips by the country’s residents will increase from 145 million in 2017 to more than 400 million by 2030.

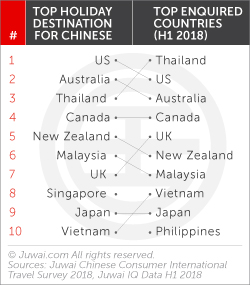

It is easy to see a canny correlation between where the Chinese search and where they eventually go for holiday. The great news for realtors based overseas looking for Chinese property customers is that Juwai’s survey also found that 74% of the holidaymakers plan to meet with 2 or more real estate agents when they are overseas.7

The Golden Week is a lucrative opportunity window for property agents and developers to present their real estate to customers who are receptive to view choice listings. While the global market for property may have taken some hits like New Zealand’s recent law to ban non-resident foreigners from buying existing homes8, there are plenty of positives around the world like in Australia9 and Thailand10 for example, where buyers seize on price slumps, over-stocked properties and improved currency exchanges.

The Chinese desire to seek stable investments for future returns is as strong as ever and will surely find ways to achieve their goals. As for agents and developers around the world, the coming Golden Week October 2018 is the bonanza.

Sources: 1. Juwai: Golden Week 2017: get set for a Chinese outbound splurge; 2. China Travel Guide: National Day 2018; 3. Jing Travel: The Number of Potential Chinese Outbound Tourists Could Double by 2020 to 240 Million; 4. China Daily: Chinese tourists spend $115b overseas in 2017: Report; 5. Fortune: The dimmed luster of China's "Golden Week"; 6. Australian Financial Review: Why Sydney property is cheap compared with Shanghai; 7. Juwai: FULL REPORT: Juwai 2018 Chinese Consumers International Travel Survey; 8. ABC News: New Zealand bans foreigners from buying property in effort to clamp down on house price growth; 9. Asia Times: Chinese buyers high-rolling back to Australia; 10. Property Showrooms: Bangkok’s residential property market remains robust in Q2

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

Sort By

- 2025

- 2023

- 2022

- 2021

- 2020

- 2019

- 2018

- 2017

- 2016

- 2015

- 2014

- 2013

- 2012

Tags

- australia

- china

- chinese buyers

- investment

- juwai

- property

- real estate

- residential

- united kingdom

- united states

Resources

Our Property Marketplaces

Juwai.com >

Global property portal available in Chinese

Juwai.asia >

Asia wide portal for global real estate

Juwai News

Subscribe to receive the latest news on Asian buyers, the Asia market, and Juwai.

Thank you for subscribing to Juwai News!

Sign up for a Juwai Account now for free to enjoy FREE download access to country-specific reports on Chinese property investments.

Do you want to sign up now? Or continue if you have already signed up or you will do it later.

Thank you!

You’ve just subscribed to get updates

to the Chinese Buyer Tips blog by email.

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service