Asia News

- Home

- News

- Asia News

You've successfully copied this link.

Which areas in Tokyo would best appeal to Chinese buyers?

Tokyo real estate has rebounded in the last few years, fuelled by several trends: the upcoming Tokyo Olympics, migration from abroad and local regions into the Japanese capital, and historically low interest rates.

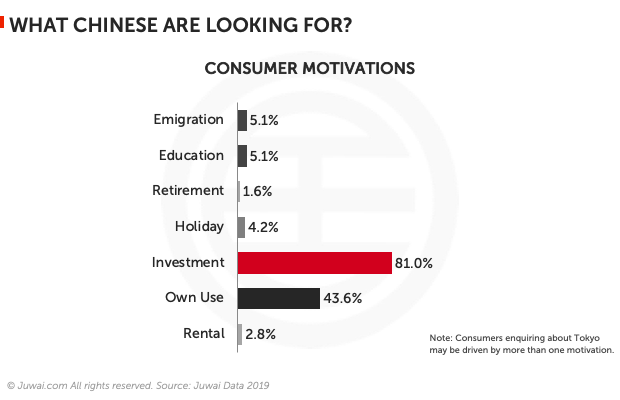

For Chinese buyers looking to invest in the capital city, options abound. We look at some areas that would draw Chinese buyers and why.

Location, location, location…

Mobility and convenience are key when it comes to purchasing any property and this is particularly true in Japan where many cities are centred around walkability and public transportation options.

Trains are one of the most popular and essential ways to travel in Japan, to the point that most locals prefer to live within a short walk, preferably 10 minutes or less, to the nearest train station. Trains form the lifeline of most Japanese cities and are the all-important link between where people work, live and play.

In Tokyo - the capital and one of the largest cities in the world - trains take on extra significance. Some Tokyo train stations are so massive they even feel like a city by themselves. Regardless of size, each station has its own unique character to support communities that live close by. Areas near train stations also tend to feature healthcare facilities, F&B outlets, convenient stores and supermarkets.

Hence, accessible areas near train stations are popular among Japanese which in turn make real estate in such locations easier to sell, rent or raise rentals if they are not for own use.

The Yamanote loop

The Japan Railway (JR) Yamanote train line which has 29 stations goes around Central Tokyo and is a key route for commuters. Tokyo is governed as 23 independent wards (23W) and five central wards (5CW) which are either completely located within the loop (considered as Central Tokyo) or have fringe areas such as Shinjuku, Shibuya, Minato, Chiyoda and Chuo spilling just outside of it.1

As such, areas within the Yanamote loop or those close to it are favoured by most Japanese as well as foreign investors. These locations offer the highest convenience and prestige in Tokyo, so they are thought to guarantee the highest occupancy rates for residential property in the capital.

The average 5CW’s rental premium is also substantial, with rental income 18.1 per cent higher on average than in the other 18 wards. Additionally, the land in the 5CW is among the most valuable in Japan and has seen noticeable increases in prices over the past few years, according to the Ministry of Land, Infrastructure, Transport and Tourism (LITT).

Investors who hope for long-term appreciation of their property, especially with the many re-developments planned in the next few years, would do well to consider investing in the 5CW.2

The suburbs

There are many reports of Chinese buying in suburbia areas - on the outskirts of Tokyo or in nearby prefectures (Chiba, Kanagawa, Saitama, etc.) that are about an 1-1.5 hours’ train ride to Central Tokyo.

Suburbs offer larger properties (some with garden and free parking space) and are much cheaper than homes in Central Tokyo. Well-selected real estate outside the Yamanote Line can, in some cases, reap ROI of five to seven per cent after tax and expenses—twice as much as many inner-city properties because the land is much cheaper.

Property types

In anticipation of the 2020 Olympics, as is often the case with a major sporting event, Tokyo has been regenerating to meet renewed real estate demand.

Many new swanky high-end properties have entered the market to cater to the growing number of domestic billionaires in Tokyo, as well as international high-net-worth buyers. Recent high-priced condos can range in price from USD91,000/sqm to UDS36,000/sqm depending on their size.3

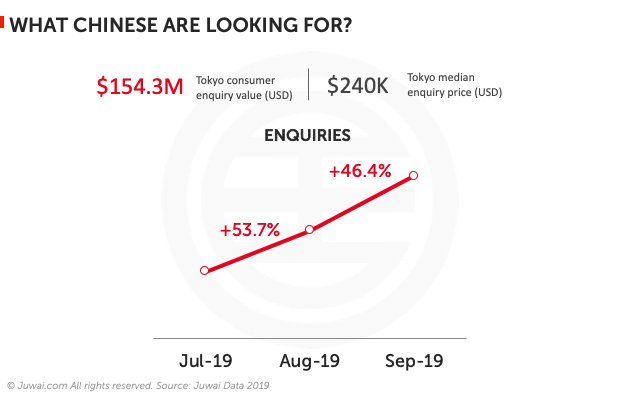

The second-hand residential market, which may be more appealing to middle-class buyers, is also showing an increase in demand as well. Second-hand properties that have been renovated are especially appealing as their asset value is maintained and buyers would not have to fork out extra for interior upgrades. Properties on the second floor or higher are also attractive for security reasons. Smaller units within the price range of USD238,000 – USD240,000 received the most enquiries, according to Juwai.com.

Sources: 1. Yamanote Line: Wikipedia; 2. Rethink Tokyo: The practical guide to Tokyo real estate. 3. Japan Property Central: The Most Expensive Apartments in Tokyo over the past 30 years

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

Sort By

- 2023

- 2022

- 2021

- 2020

- 2019

- 2018

- 2017

- 2016

- 2015

- 2014

- 2013

- 2012

Tags

- australia

- china

- chinese buyers

- investment

- juwai

- property

- real estate

- residential

- united kingdom

- united states

Resources

Our Property Marketplaces

Juwai.com >

Global property portal available in Chinese

Juwai.asia >

Asia wide portal for global real estate

Juwai News

Subscribe to receive the latest news on Asian buyers, the Asia market, and Juwai.

Thank you for subscribing to Juwai News!

Sign up for a Juwai Account now for free to enjoy FREE download access to country-specific reports on Chinese property investments.

Do you want to sign up now? Or continue if you have already signed up or you will do it later.

Thank you!

You’ve just subscribed to get updates

to the Chinese Buyer Tips blog by email.

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service