You've successfully copied this link.

Chinese buyer activity looks to bounce back from coronavirus outbreak

Wuhan set to lift draconian restrictions in force for over two months, ending lockdown, as China gets people back to work

On 24 March, China’s Hubei province announced it will allow transportation to resume in Wuhan on 8 April, effectively lifting a mass quarantine over the city where the coronavirus first emerged last December. People in Wuhan will be allowed to leave the city and Hubei province, according to a statement on the provincial government’s website.

The news gave hope to the rest of the world battling the pandemic that even the most severe situation can be turned around.

On the road to recovery

Only six weeks after the initial outbreak, China appears to be in the early stages of recovery, according to a report by Harvard Business Review (published on 10 March) which measured three benchmarks in China – movement of goods and people, consumption of coal and property transactions.

Movement of people and goods has now reached 73 per cent of 2019 levels. Coal consumption also appears to be recovering from a trough of 43 per cent to currently 75 per cent of 2019 levels, indicating that some production is resuming. Real estate transactions have also rebounded, bouncing back up to 47 per cent after falling to just one per cent of 2019 levels.

China's state planners say the country's economy will return to normal in the second quarter of 2020 as government support measures to mitigate the impact of the coronavirus epidemic take effect.1 Data released by China's National Bureau of Statistics showed that demand and supply chains were significantly affected in the first two months of the outbreak, but the impact of the coronavirus was temporary at the same time. The emergency policies that were implemented have gradually helped to stimulate the economy, signalling that China will soon return to normal.

Latest data from China’s National Development and Reform Commission also supported the recovery news. The Commission says the national industrial return-to-work rate has reached 90 per cent, and some are nearly 100 per cent. A total of 185.3 billion yuan of fixed assets investment were made in January and February and entrepreneurs are confident that China’s economy is gradually stabilising. The Commission also noted that many businesses have adopted online strategies to cope with outbreak as well as to minimise disruptions.

Customs, airports, ports and roads in most cities have resumed operations while offices and factories have reopened, according to the Shanghai Municipal Commission of Economy and Information. Work has largely resumed across China with production estimated at 60-70 per cent capacity. Large manufacturing sectors that are currently operating at 50-60 per cent capacity are expected to reach full production capacity no later than middle of March.

Real estate markets are optimistic

Although the current quarantines and travel restrictions imposed by many countries to contain the spread of Covid-19 are hampering site visits and viewings, most realtors are optimistic that Chinese buyers activity will pick up once the pandemic is brought under control.

For instance, Western Australia’s property market remains strong despite the spread of COVID-19 in the country. According to Lily Chong, a real estate agent from IQI Western Australia, COVID-19 has not deterred Chinese buyers from buying property in Australia.

“I have a buyer from China who cannot travel here but is still purchasing. Until recently, we never actively sold to China. But through the Juwai.com platform, where we started advertising three weeks ago, I have received five Chinese buyer enquiries. We have posted 26 properties on Juwai.com and already received enquiries,”

said Chong who helped transact the sale of a AUD1 million East Perth apartment by email.2

In Thailand, industry watchers say the Thai real estate sector is continuing to see a downward trend from last year due to postponement of new launches and discounts on unsold units. However, while Chinese buyers have tailed off after travel restrictions imposed by Beijing, they say Chinese buyers remain active online and are still interested in Thai property.

Hongkongers are also eagerly eyeing global properties on the cheap, as a turbulent market crushed major currencies. The Hong Kong currency, pegged to the US dollar, is currently trading at the stronger end of its band. It has appreciated by between 4.7 per cent and 15.5 per cent so far this year against top major and regional currencies, including the British pound, Canadian dollar, Australian dollar, Euro and Singapore dollar, according to Bloomberg Market data.

Deep-pocketed investors, looking to emigrate from the city after experiencing months of social unrest in 2019, are aware of their buying power and enquiries about overseas home purchases and immigration have increased by one third to 650 cases in the first two and a half months, compared with a year earlier, according to an immigration consultancy company which said the most popular request is for relocation to Australia. The company expects the cases to reach a record 1,500 this year, surpassing last year’s figure of 1,000.3

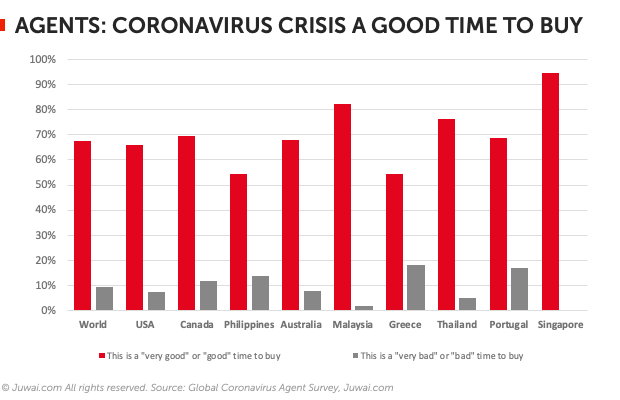

Juwai.com also conducted a global survey of real estate agents and the impact of coronavirus. Results show that most agents are optimistic about Chinese buyers, saying most of them are still keen to buy overseas properties.

Strong Chinese yuan may add to Chinese buyers’ impetus to invest

As COVID-19 continues to spook global markets, China shares on the other hand seemed to have trimmed losses and the Chinese yuan made a rebound. Its strength for the past several weeks has pushed it to a 10-month high relative to a basket of trading-partner currencies such as the US dollar, the British pound, the Australian dollar, the Euro and other Asian currencies. The weaker Australian and UK currencies, in particular, offer a great opportunity for Chinese buyers looking to invest in these countries.

Sources: 1. Reuters: China's economy will return to normal in second quarter, state planner says; 2. Realestate.com.au: Western Australia’s property market holds strong during COVID-19; 3. South China Morning Post: Hongkongers relish picking up overseas properties on the cheap as currencies slump amid market stampede

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service