You've successfully copied this link.

First quarter of 2020 sees increase in Chinese buyer enquiries

Pandemic did not quell Chinese appetite for cross border property acquisitions, according to Juwai.com’s second report on the impact of Coronavirus on global real estate market.

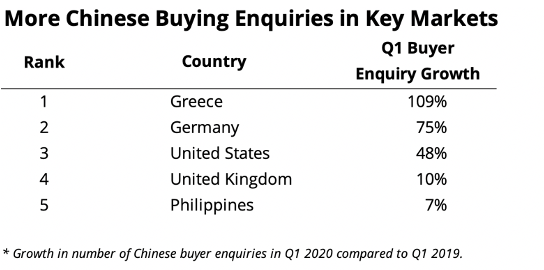

Despite the virus and the resulting disease, Covid-19, wreaking havoc across the world, Chinese buyers are still interested in purchasing overseas properties. Among the countries that saw increased interest from Chinese buyers in the first three months of 2020 are Greece, Germany, the United States, the United Kingdom, and the Philippines. This was revealed by Juwai.com’s second report on the Coronavirus, based on buyer enquiries received by the website.

Without a doubt, the first quarter of 2020 saw real estate markets across the globe reeling from the chaos created by the spread of the virus. Beyond the human tragedy of the pandemic, cross-border buyers face a host of challenges which included travel bans and quarantine lockdowns in destination markets. All these ultimately hindered transactions.

Although China was the first to suffer from the pandemic, it is now the first to emerge from its shadow. Chinese consumers, especially in Tier 1 cities, have resumed work and are planning again for their future. This includes seeking alternative homes outside of mainland China and acquisition of foreign real estate.

Testy times for real estate industry

In normal times, buyer enquiry trends serve as a reliable indicator of future transaction trends. However, current stagnant markets and travel restrictions have created extended delays for some buyers between the time of enquiry and ultimate purchase.

As a result, Chinese buyer transactions dropped in the first quarter even as enquiries increased in some locations. This indicates that buyers want reassurance that the economy is recovering before committing to a significant purchase.

Perhaps the largest class of Chinese buyers active today are bargain hunters who are willing to endure pandemic-related risks to save 5%, 10%, or more off recent prices

Long-term impact

It is too soon to draw any firm conclusions about the long-term impact on Chinese demand for overseas real estate, but some possible outcomes could be attributed to:

• A reordering of investment flows towards countries that best handle the pandemic.

• Declining demand for riskier and speculative investments.

• For wealthier investors, a recommitment to diversify real estate investments that will protect wealth rather than yield profits.

A brief summary of the five countries that saw increased Chinese buyers’ enquiries.

Greece

In the first quarter, Chinese buyers made 109% more buying enquiries on Greek residential property. Surprisingly, demand for Greek property peaked in the month of February, when much of China was in quarantine lockdown.

Greece is the 12th most-popular destination for Chinese buyers, ranking higher than Spain and Germany. Its popularity is due to rapid price growth and strong market performance as the country continues to recover from previous financial crisis. Another attraction is its Golden Visa programme.

While Chinese demand for Greek golden visas remains strong, the rate of approvals dropped dramatically in Q1 as the Greek Immigration Bureau offices shut down in March due to the pandemic. The bureaucratic stall hits Chinese applicants most directly because they make up 80% of all applicants.

Germany

In the first quarter, Chinese buyer enquiries climbed 75% in Germany as the country jumped from 14th to ninth in rankings as among the most popular destinations worldwide for Chinese residential property acquisition.

The three top German cities favoured by Chinese buyers are Berlin, Düsseldorf and Munich.

After acting decisively to mitigate and treat new infections, Germany may emerge a relative winner in economic terms from the pandemic. The country as such may be one of the first in the Western world to emerge from lockdown and return to near normalcy.

This has prompted some marketers in China to promote Germany as a safer destination for higher education instead of the UK and the US due to its efficient and meticulous handling of the crisis.

United States

Chinese enquiries on US property climbed by 48% in the first quarter, as the country’s role as a global investment safe haven brought back buyers who were kept away by the trade war and heated political rhetoric in 2018 and 2019. The top US cities for Chinese buyers in 2019 were Los Angeles, Seattle, New York, Orlando and Houston.

Apparently, the security of investment in the US outweighed the country’s quarrelsome response to the pandemic. Chinese and other Asian buyers are also driven by worries about the Chinese economy, a possible devaluation of the Chinese currency, and a desire to protect their wealth by diversifying their investments.

United Kingdom

Chinse buyer enquiries climbed 10% in the United Kingdom in the first quarter.

While the UK residential property market faces severe difficulties in the first two quarters of 2020, analysts have a more positive outlook for the second half of 2020 and for 2021. With the United Kingdom still in lockdown at the time of writing, many transactions are stalling.

Analysts predict at least 500,000 local and foreign buyer transactions will be lost but market activity will resume once the crisis has passed.

The Philippines

Despite falling victim to the pandemic in early 2020, Chinese buying enquiries for Philippine real estate increased by 7%. Manila real estate has performed admirably in recent years, driven in part by expat Filipinos, a constrained supply of luxury properties, economic growth, and foreign buyer demand — especially from China. Manila accounts for 68% of Chinese buyer enquiries.

To date, the Philippines has yet to flatten the curve. This would undoubtedly make it more difficult for Chinese buyers to complete transactions.

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service