You've successfully copied this link.

Here's why domestic restrictions are driving Chinese buyers abroad

Chinese buyers bought a record ¥9.9 trillion ($1.4 trillion) worth of real estate in China last year, up 36.1% y-o-y.1

That goes to show how much value Chinese place on property, which has long been considered as one of the safest and most favoured choice of investment for most Chinese.

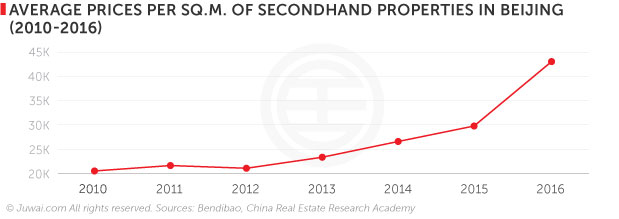

The Chinese passion for owning property is so strong that by the end of 2016, rampant demand from Chinese buyers drove a stunning increase in China’s housing prices, with hotspots like Shenzhen and Beijing seeing pricing increases of 23.5% and 25.9% y-o-y.2

China unleashes strictest property controls yet

Let's face it, China's property market is red hot, and the continued buying frenzy by mainland Chinese is a cause of concern for the Chinese government.

Hence, it came as no surprise when over 20 city governments in China imposed even more restrictions on top of the existing property rulings in a bid to rein in property price growth.

Here’s a brief lowdown on some of the new policies – some of the strictest controls to date – below:

- Higher minimum downpayments: First-time buyers will now have to put down much more to secure a property in China. Minimum required downpayments in Beijing have now been raised to 30% from 20%, while buyers looking to acquire a second home face even tougher rules – minimum downpayments increased to 60% from 50%, and even higher to 80% from 70% for high-end properties.3

- Tighter liquidity raises mortgage rates: Over the past year, China’s central bank has urged banks to strengthen mortgage risk management to stem the flow of credit to the real estate market. The result? The Beijing branches of six major Chinese banks have hiked up interest rates on housing loans for first- and second-home buyers, effective from 1 May 2017 onwards.4 Leading mortgage lenders, such as China Construction Bank, has removed its discounts for first-time home buyers, while the Agriculture Bank of China has also discontinued its preferential mortgage rates for first-home buyers as well.5

- Curbs on inter-city investment and multi-home ownership: Property investors looking to buy property across China to build a diversified portfolio have been stymied by new qualifying criteria for home loans. For example, Suzhou has made loan applications conditional on evidence of at least one year of tax returns in the city, plus evidence of residence and employment, making it nigh on impossible for non-resident buyers to invest in the market.

Targeted policies, nationwide scope

These kinds of restrictions on real estate investment have spread far and wide in China, ranging from tier-1 cities of Beijing and Shanghai, to lower-tier locations such as Chengdu, Wuhan, and Zhengzhou.

The new round of policies has limited access to one of Chinese investors few domestic investment channels, and one that has delivered stellar returns during the past ten years. Already, China has few alternative options compared to the US and Europe because its capital markets are much less developed.

However, with Chinese perceiving real estate being to be a solid bet, many have been looking for other ways to continue buying property over the past few years, including divorce, a popular option that has resulted in a surge of 'paper divorces' (fake divorces) nationwide in China purely for the sake of buying a property.5

Why such measures? Here's an example to explain why.

In Shanghai, a couple buying their first property can do so with a 30% deposit, while buying a second property requires a massive downpayment of between 50% and 70%. When divorced, however, one half of the couple is still eligible for the 30% first-time buyer rule, should the husband or wife do not own any property or mortgage under their names.6

With Shanghai property prices already sky high, it makes much sense for couples to willingly divorce in order to qualify for the 30% deposit policy, which makes it more affordable for them to purchase a second property to diversify their investment porfolio.

While it sounds farfetched, the fact remains that registration offices both in Shanghai and across the country have been overwhelmed with Chinese couples rushing to divorce last year, prompting the municipal governments in Shanghai and Beijing to recently impose new rulings to close that loophole.7

It’s against this backdrop of narrowing opportunities in the domestic market that overseas property is becoming an eminently enticing option for Chinese investors.

Juwai.com saw a 47.2% increase in Chinese buyer views for Canada property, a 42.7% uptick in US property views, and a 32.5% y-o-y jump in UK property views in February 2017.8

Furthermore, although China’s government has introduced capital controls, Chinese investors are adapting by shifting the focus of their searches to lower-priced property, leaning more on overseas mortgage financing, and pooling transfer allowances to build enough for a deposit on an overseas property.

4 rising overseas property market alternatives for Chinese

With a narrower range of domestic choices, especially when compared with more attractive overseas market alternatives, as well as the opportunity to invest abroad whether for a new life overseas, educational reasons or retirement, it’s clear that the drivers are in place for a solid increase in demand from Chinese buyers for overseas property.

In fact, Juwai.com saw a 6.7% y-o-y increase in overall Chinese buyer enquiries for international property in March 2017.8

We share 4 up-and-coming real estate markets abroad that may benefit from growing Chinese buyer interest this year:

#1 Portugal

Golden Visas in Portugal are available to international investors for as low as €350,000.9 Besides attractive pricing, Portugal offers excellent lifestyle standards, low cost of living, and popular locations like Lisbon and The Algarve, which are highly attractive to Chinese investors. Last year saw Chinese buyers investing €874 million in Portugal’s Golden Visa, and seeing as property prices in Portugal are expected to grow at least 4% in 201710, a steady flow of enquiries by Chinese buyers looks quite likely.

#2 Florida, US

Seven of the top 10 US real estate markets for 2017 are in Florida, and with good reason too. New direct flight links to China, excellent climate, clean air, and yields of around 10% make Florida a highly attractive location for Chinese buyers. In fact, Juwai.com charted an 894% and 199% y-o-y growth in Chinese buyer searches for properties in Fort Lauderdale and Orlando in 20168, and China President Xi Jinping’s recent trip to Mar-a-Lago at Florida's Palm Beach has helped boost Florida in the eyes of Chinese as well.

#3 Gold Coast, Australia

A favourite with Chinese travellers to Australia, Gold Coast is a strong contender for Chinese buyer attention. Gold Coast ranked as the fourth most searched-for Australian location on Juwai.com in 2016, and offers great potential for development. Total Chinese visitors topped 295,000 last year11, but an expanded range of direct flights to mainland China is likely to drive more Chinese to visit Gold Coast and – should they fall in love with its sunny beaches and lifestyle – perhaps purchase a home there.

#4 New Zealand

Christchurch and Auckland make New Zealand another up-and-coming darling for Chinese buyers. As the fifth most popular country for Chinese property investors on Juwai.com, New Zealand saw a 112% y-o-y increase in Chinese buyer searches in 2016.8 Fired by closer flight links, longer visa validity, an outstanding climate, a range of outdoor lifestyle option, and Westpac’s estimate of at least 5% growth in property values in 2017, we perceive New Zealand to see solid demand this year as well.12

Agents, make your move

With overseas property purchase being the most popular form of overseas investment for China's high net worth individuals (HNWIs)13, and with competition rapidly increasing in this battle for Chinese buyers, you need to be at the top of your game to stake a claim for this highly lucrative market.

Undoubtedly, online listings offer an efficient, targeted way of accessing China’s colossal online market of 731 million internet users14 but it doesn’t just stop there – a social media presence on platforms like WeChat, Weibo, and QQ is also vital, since social media is the first port of call for Chinese real estate investors when searching for overseas property.

Your offline strategy matters as well. With Chinese travelling overseas in greater numbers than ever, getting your ground game right is also crucial, so be sure you tailor you property tours for Chinese, as it's an excellent way to educate and guide prospective clients.

That said, considering Chinese are expected to spend an estimated $225 billion on overseas property by 202515, it could be well worth your while to factor in these tips, and form a multi-channel approach within your China market strategy.

Sources: 1. National Bureau of Statistics: Economic data 2016; 2. National Bureau of Statistics: Real Estate Price Index, December 2016; 3. SCMP: Beijing rolls out harshest ever home buyer down payment; 4. Reuters: China banks hike lending rates for Beijing home buyers; 5. SCMP: China's interest rates poised for a quick rise, in response to US moves; 6. BBC: Why are Shanghai’s happy couples getting divorced?; 7. SCMP: China mortgage rules tightened to curb people divorcing to qualify to buy second homes; 8. Juwai IQ Data; 9. Ideal Homes: Property prices set to rise further; 10. Gold Cost Bulletin: An extra 100,000 Chinese tourists visited the Gold Coast in 2017; 11. Stuff: Chasing the Chinese dollar; 12. Mortgage Express: What can we expect in 2017?; 13. Hurun Report "Immigration and the Chinese HNWI 2016; 14. Tech In Asia: China now has 731 million internet users, 95% access from their phones; 15. Auction.com: Top four reasons Chinese buyers invest in U.S. real estate;

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service