You've successfully copied this link.

China's retirees: an emerging force in global property markets

340 million – that’s the forecasted China’s greying demographic aged 60 and above by 2030.1

That’s an increase of 175 million from the current count of 165 million Chinese retirees1 – a figure that not only exceeds the current population of the US2, but also makes them an emerging force in global property markets that will amount to one of the world’s largest consumer base.

More importantly, this massive market of China’s silver generation has equally substantial funds at their disposal.

Older Chinese are sitting on a hefty share of the $2.4 trillion in savings3 planted in China’s banks4, having lived through China’s boom years, benefited from rising incomes, and capitalised on China’s fast-growing property markets.

Already, their wealth is already impacting global property markets, albeit indirectly. Chinese insurers, custodians of billions of RMB in retirees’ pension and insurance plans, are steadily channelling their cash piles into global property markets, investing $3.1 billion in overseas real estate in H1 20165, and with a further $73 billion expected to follow by 2019.6

China’s silver generation more globally savvy and discerning

Aside from insurers, individual retirees – or those planning for future retirement – are now becoming much more active in global property markets, in part because their horizons are broadening.

The waves of outbound tourists from China, which numbered 120 million in 2015 and is projected to hit 139.2 million this year, are becoming more globally savvy as they get to know more countries around the world, and older generations are well and truly part of this outbound trend.

The China Outbound Tourism Institute estimates tourists aged 60+ accounted for 5 million trips in 20157 and China Britain Business Council estimating a US$34 billion potential spend from this age group.8

In fact, another recent Citi report revealed that outbound tourism by Chinese elderly have skyrocketed as much 217% last year alone.9

Increased awareness of overseas opportunities gives retirees more options to build an overseas lifestyle as well.

57% of Chinese high net worth individuals (HNWIs) prefer to retire in a home of their own, in preference to care homes.10

This is because times are changing, and no longer are China’s rich and wealthy completely adhering to the Confucian ethic of filial piety, whereby Chinese children take care of their elderly parents when they are unable to care for themselves.

Instead, Chinese HNWIs are now in pursuit of independence after retirement, an option that came about due to a growing awareness of the pressures placed upon their children – most who are a single child born under the one-child policy – as well as a desire to not burden them, if possible.11

And for this silver generation, ‘independence after retirement’ translates into living away from their children as they search for relaxed and enriching lifestyles that come hand-in-hand with plenty of travelling around.

Healthcare a top focus for China’s elderly

That said, with China’s dubious environmental quality, many Chinese retirees are on the lookout for an overseas property with access to both top quality medical care and attractive living environments while jet-setting around the world.

In fact, Chinese spent $10 billion on medical tourism in 2015 alone, of which Chinese retirees are an important part of this market – and it’s this growing market that is helping to spur property investment in destinations famed for medical treatments, such as in the US.

50% of China’s HNWIs cited healthcare as their primary concern and main topic of interest for 2016.10

Asides from lifestyle concerns, Chinese retirees are also generational investors who also want to ensure that they are providing for the next generation.

Asides from lifestyle concerns, Chinese retirees are also generational investors who also want to ensure that they are providing for the next generation.

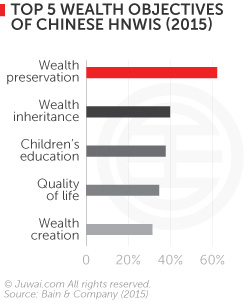

According to research from Bain & Company, Chinese high net worth individuals factored inheritance, children’s education, and life quality as three of their top five wealth objectives.12

With this in mind, an overseas property in a suitable location not only offers a Chinese retiree a unique opportunity to meet their lifestyle aspirations, but also provides both a springboard for their children and grandchildren to enjoy overseas educational opportunities, as well as securing a high-value asset which they can pass on to the next generation.

Connectivity, easier visas, and better pension access broadening retirees’ horizons

Even as Chinese mentality is changing, so is the world to make it easier than ever for Chinese retirees to seek an overseas retirement.

Today, China has become more closely connected with the world, driving what Boeing expects will be a 3x increase in total passengers travelling between China and the US alone by 2021.13

This factor, together with expanding international transport links from China’s lower-tier capitals, will open up many more opportunities for travel, and make it more feasible for retirees to split time between bases at home and overseas.

Countries all over the world are opening their doors to Chinese investors too. Recent moves by Singapore, Australia, the UK, and the US to increase multiple entry visa validity for up to 10 years – plus the raft of ‘golden visa’ residency programs offered by locations such as Portugal, Spain and Greece – all mean that Chinese retirees are now spoilt for choice when it comes to choosing overseas retirement locations.

Interestingly, China’s government is making it easier than ever before for retired Chinese residents living overseas to claim their pensions as well.14 Previously, a convoluted claim procedure meant that many overseas-based Chinese retirees gave up seeking their pensions. However, this policy change now recognises their overseas status, thus giving them greater confidence in supporting themselves overseas.

A greying economy but a golden opportunity

Powerful demographic trends, an increasingly outward looking customer base, and improving links between China and the outside world are aligning to create a high-potential market of Chinese retirees looking abroad for property.

Furthermore, Chinese retirees have money to spend – China’s state-run Research Centre on Ageing forecasts total expenditure by Chinese retirees to reach RMB1 trillion by 2050.15

So agents, it’s time you tailor your offerings to suit China’s older generation. Here are three ways how:

- Educate them: An overseas investment is a huge step, particularly a Chinese investor with little knowledge of property sales procedures in new countries. So, be sure to manage expectations by including a step-by-step breakdown of a sales process as part of your product pitch, outlining fees and levies clients will expect to pay as part of the process, and explaining terms associated with a property, e.g. freehold, tenancy.

- Put yourself in their shoes: While they may be commonplace in the UK, US, Canada or Australia, most Chinese – particularly the older generation – haven’t grown up with gardens, garages or pools. So do some research to find out what features may appeal to them, and make sure you put features like this front and center in your pitches to add more allure to your properties.

- Highlight local facilities: Health and education are a huge concern for China’s silver generation, so be sure to offer details of medical, wellness, and educational institutions in the local area. Chinese investors are looking to tick as many boxes as possible with their property purchases, so pack your pitches with as much relevant information as possible.

Chances are, strategies like these can win you interest, trust, and completed deals from China’s retirement-minded property investors, so good luck with your promotions, and here’s to a golden return from China’s greying economy.

Sources: 1. Brookings Institute: China’s one-child policy at 30; 2. US News: US population in 2015; 3. Naked Capitalism: The puzzle of China’s rising household saving rate; 4. Wikipedia: List of countries by GDP; 5. Fortune: Why Chinese investment in overseas real estate has more than doubled; 6. SCMP: The Chinese are coming: Insurers expected to pour US$73b into overseas properties; 7. COTRI: Elderly Chinese, a market segment of increasing importance; 8. China-Britain Business Council: China’s silver consumers; 9. Citi Report on SCMP: Goodbye tour buses and loud hailers: Chinese tourists now choosing the more personal approach; 10. Hurun Report: Retirement Planning & Healthcare of Chinese HNWIs 2016; 11. Jing Daily: China’s rich opt for luxury nursing homes over filial obligations for aging parents; 12. Bain & Company/China Merchants Bank: China Private Wealth Report; 13. Boeing: Current Market Outlook: 2015-2034; 14. China Daily: Simplified process helps Chinese retirees in US get pensions from overseas; 15. SCMP: Navigating through China’s grey economy

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service