You've successfully copied this link.

Wealthy Asian property investors determined to buy Australian real estate despite Covid-19 restrictions and tense Sino-Australian relations

Foreign investors, especially Chinese and other Asian cross-border property buyers, are still hungry for Australian real estate despite a slowdown in global economy and Coronavirus restrictions delaying transactions.

Australia's economy is widely expected to plunge into recession in 2020 for the first time in 29 years as COVID-19 shutdowns pushed unemployment into the double digits. This downturn will be the sharpest since the Great Depression in the 1930s and one of the casualties will be the real estate market, especially in Sydney and Melbourne, where house prices are expected to fall drastically.1

According to an article by The Sydney Morning Herald published in May this year, the National Australia Bank (NAB) expects a 10 per cent fall in house prices in 2020, followed by 2.6 per cent growth in 2021, but has warned a "severe" downturn could lead to prices falling as much as 20.9 per cent in 2020 and 11.8 per cent in 2021 before a modest recovery in 2022. ANZ has forecast a 4.1 per cent fall in 2020, followed by a 6.3 per cent fall in 2021. SQM Research, meanwhile, forecast of a 30 per cent plunge in median real estate values for 2020.2

Nonetheless, industry experts say cashed-up foreign property investors, especially those from China and the rest of Asia, are likely to maintain an interest in Australian properties which could help prop up the real estate sector. The three top cities sought after by foreign buyers, especially those from mainland China, are Sydney, Melbourne and Brisbane.3

Foreign buyer activity sustaining market

According to NAB’s Q2 2020 Residential Property Survey, the quarter saw higher activity from foreign buyers in comparison with Q1. Victoria saw the most transactions taking place where foreign buyers account for 19.3 per cent of new home market share – its highest level in three years. That means one in five of new homes sold in the state was purchased by a foreign buyer. In other states, the average foreign buyer share of new property purchases in New South Wales is 9.1 per cent; in Queensland 12 per cent; and Western Australia 6.3 per cent.4

Notwithstanding the fact that Australia’s property market is currently in a state of flux with viewings and transactions largely halted in many cities, these NAB survey suggest foreign investors may be responsible for the uptick in buyer activity.

Chinese and other Asian buyers driving demand

Many realtors say Chinese have been driving the demand for Australian property. At Juwai.com, Chinese buyers made 40.1 per cent more inquiries on Australian real estate in the second quarter of 2020 than in the first, defying negative sentiments about the global pandemic, travel bans, lockdowns and dispute between Canberra and Beijing over the origins of the Covid-19.

Juwai IQI enquiry data shows that during the first half of 2020, Chinese buying in Australia was down 14 per cent while local buyer activity plummeted by some 40 per cent. This indicates that foreign buyers may have helped support the market at a time when the outlook was otherwise bleak.

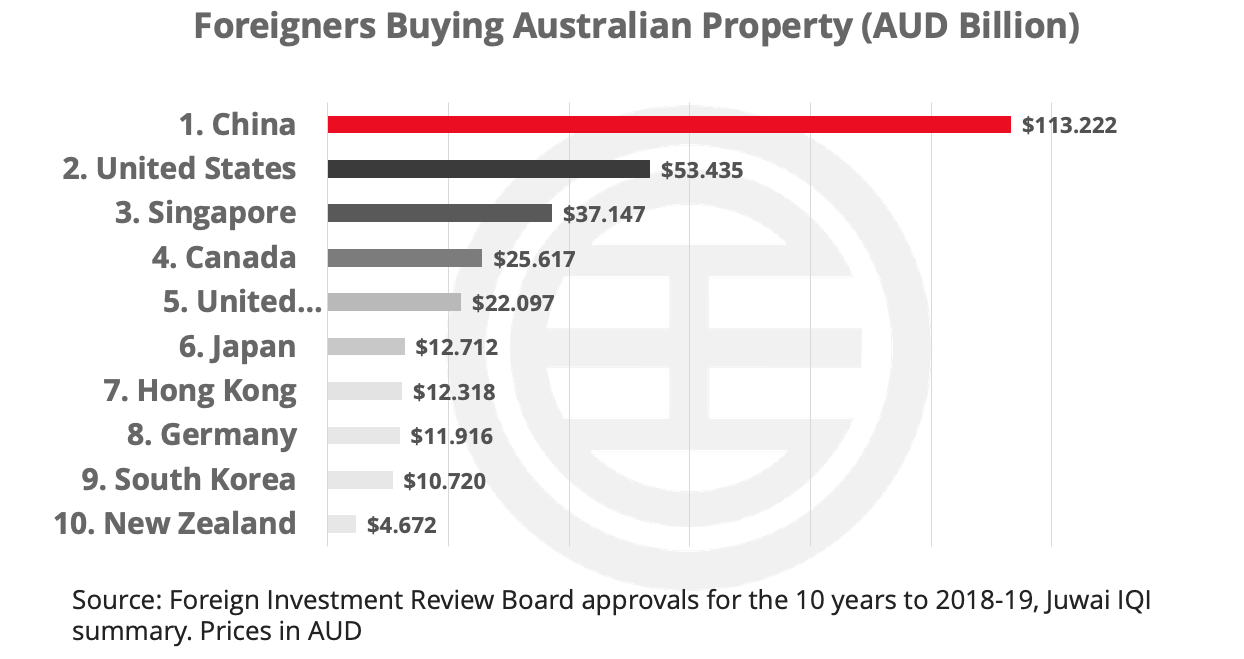

And it is not just the mainland Chinese, but other wealthy Asians are just as interested in Australian property during this time of crisis. Data from Australia’s Foreign Investment Review Board shows cash-rich investors from Hong Kong, Singapore, South Korea and Japan spending more on Australian real estate during the past decade than buyers from the US, the UK, Canada, New Zealand and Germany,

Buyers from mainland China were allowed to snap up AUD113.2billion worth of Australian residential and commercial property in the decade leading up to the 2018-19 financial year, making up 19.3 per cent of all foreign asset purchases while buyers from five other Asian countries have bought AUD186.2billion worth of Australian real estate during the past 10 years, compared with AUD117.7billion from five Western nations.5

This has prompted realtors and online property portals to start catering for the very rich from other parts of Asia besides China. Experts say COVID-19 had done little to diminish the determination of Asian property investors to expand their global portfolio even though it has dealt a painful blow to economies all over the world.

Knight Frank's Wealth Report for 2020 found that Australia is the fourth most popular residential property market, after the US, UK and Singapore, with ultra high-net-worth (HNW) Asian cross-border property investors.

Realtors catering to foreign buyers say the pandemic may have given added impetus to buyers to indulge in cross-border purchases and also accelerated the use of new technology tools - virtual walkthroughs, 3-D mapping, drone surveys, webinars and video livestreaming – by sellers to engage with customers who are not able to travel for site inspections or attend face-to-face appointments.

Why are Asians rushing to buy in Australia?

Several reasons currently make Australian real estate very conducive for foreign buyers:

- Lower prices. Home prices nationally fell 0.6 per cent in July this year, with a 0.8 per cent average decline for capital cities and flat prices in the regions. Melbourne (-1.2 per cent) and Sydney (-0.9 per cent) had the biggest price falls due to the sudden resurgence of Covid-19. And if the conditions do not improve, bigger falls are expected ahead. 6

- The Australian dollar has been hit relatively hard because GDP expectations in the country have had to be revised downwards. As a result, there are significant savings for Asian investors who are buying into the Australian market.

- Australia is home to more than 1.2 million people of Chinese ancestry, many of whom only migrated in the last decade - ensuring deep community links. Chinese consumers continue to favour Australia for education and tourism, partly for this reason.

- Australia is popular with foreign students. In 2019, there were over 750,000 international students in Australia,7 according to government data. Students from China account for the greatest portion of enrolments in higher education and parents tend to purchase property to accommodate their children studying in the country.

- Australia has performed better in mitigating the pandemic compared to the UK and the US which have been hit harder by the virus. This has convinced cross-border buyers of the country’s better health security measures.

Australia tops list for commercial property with Chinese

Although the coronavirus pandemic has resulted in the total value of offshore investment plunging by half, Chinese investors are still flocking to the country for commercial real estate investment.

Data from Juwai IQI shows Australia is now the top commercial property investment destination, superseding the US, for Chinese property investors, even though overall Chinese cross-border buying enquiries fell by 27 per cent in the three months to the end of June.

Sydney attracted the lion’s share of investment at AUD3.2 billion, but that was down 50 per cent on 2019. Investment in Melbourne fell similarly, plunging 47 per cent to AUD1.72 billion in the first six months of 2020.8 The lockdowns in New South Wales and Victoria have hit commercial landlords doubly hard as non-essential businesses are not allowed to operate, while a moratorium on eviction of financially-distressed commercial tenants has hampered repurposing of properties.

However, given the relatively small size of Australia’s commercial property market, experts say this continues to show that Chinese appetite for Australia’s real estate has not waned. The preference for Australian assets reveals the country’s strong outlook for yields and capital returns, its close economic ties to Chinese industry, and its positive long-term outlook for economic and population growth.

Looking forward

Notably, China is now the first country to emerge from the coronavirus downturn. Stimulus money and extremely low interest rates are making many Chinese eager to purchase hard assets like real estate. Real estate purchases in China itself are soaring and the demand is spilling over the border into Australia as well as other countries.

Still, there is no crystal ball to determine what will happen with the Australian property market over the coming months as Covid-19 continues to disrupt businesses across the country. Yet this much is certain. Foreign buyers, especially the Chinese, like Australia and if they can afford to buy, they will continue to do so regardless of the situation, say industry observers.

Sources: 1. ABC News: Australia in its first recession in 29 years as March quarter GDP shrinks; 2. The Sydney Morning Herald: Banks warn house prices could fall up to 30 per cent as rental vacancies surge; 3.Realestate.com: ‘If Chinese buyers can buy, they will’ despite COVID19 delays; 4: NAB Residential Property Survey Q2-2020; 5. Daily Mail: Ultra-rich foreigners are MORE determined to buy up Australian property during COVID-19 and they're not just from China; 6. ABC News: Home prices ease in July but there are warnings of bigger falls ahead; 7.CNBC: Australian official urges international students to consider studying in the country as China claims racism; 8.Australian Property Investor: Australia now top market for Chinese investment

Liked this article? Sign up for free to get Juwai Juwai Asia Market updates!

2025 © Juwai. All Rights Reserved Privacy Policy | Terms of Service